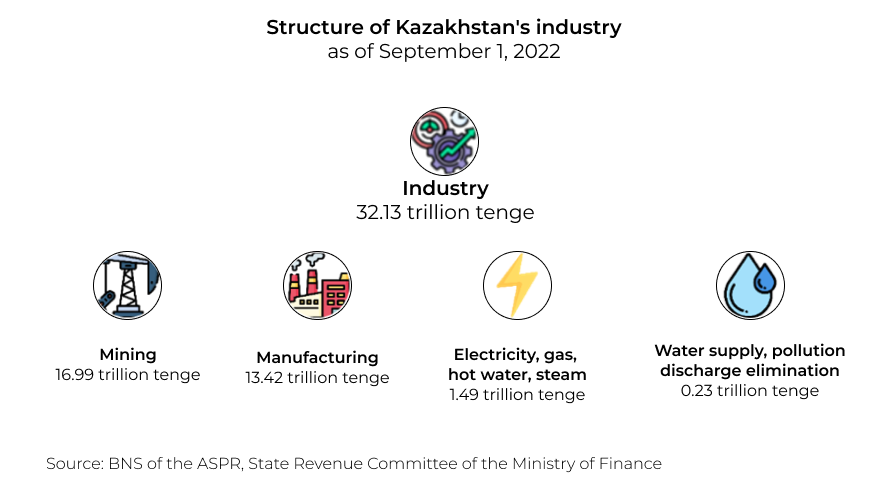

In 2022, Kazakhstan produced industrial products totaling 32.13 trillion tenge, of which 52.9% was in the mining industry – 16.99 trillion, and 41.8% in the manufacturing industry – 13.42 trillion tenge.

Although the industrial sector is growing in monetary terms by 39.8% compared to last year due to high oil prices, the industrial production growth is slowing from 5.8% according to the results of the 1st quarter to 2.5% in 8 months. The situation is mostly related to the stagnant growth rates of the mining industry (+0.7% for 8 months of 2022 versus +3.1% for the same period of pre-crisis 2019): there are problems in the oil and gas industry, and the growth of metal ore production has significantly decreased.

Why is there stagnation in the mining industry with high energy prices?

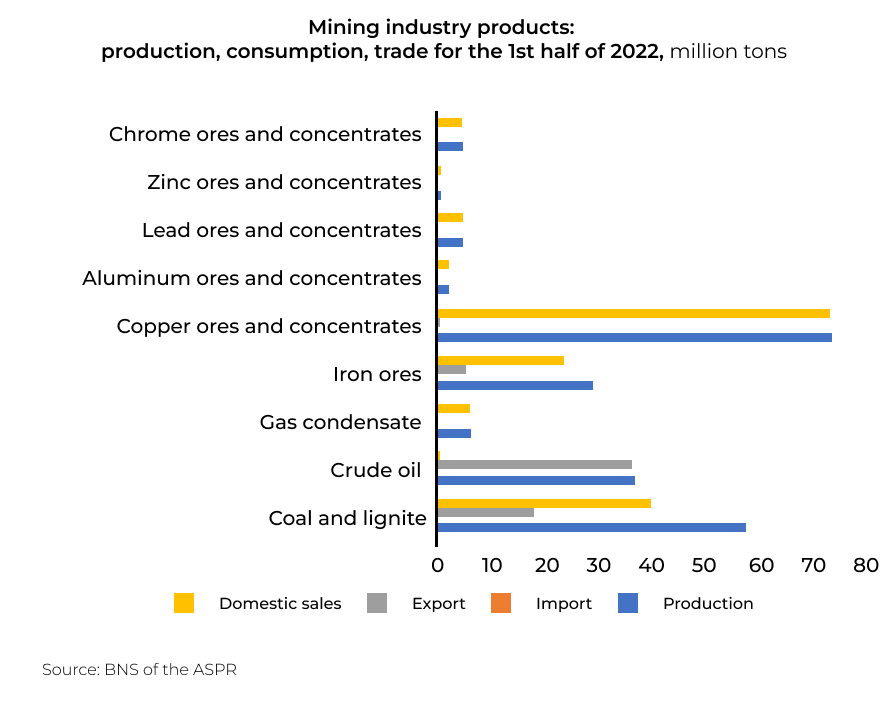

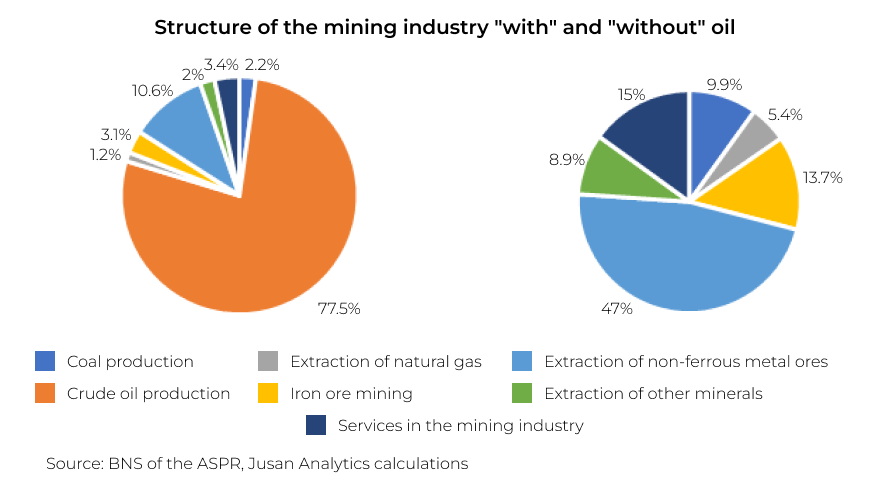

The main share in the mining industry is oil production (77.5%). Kazakhstan’s economy is high-dependent on the situation in the oil sector, which accounts for about 19% of GDP. Following the latest data, oil production remains at the level of last year, while according to the 1st quarter of 2022, production grew by 7.6%. The main reasons are the followings: unscheduled repair work at Kashagan, planned work at Tengiz and interruptions in the Caspian Pipeline Consortium (CPC) pipeline operation, through which about 80% of oil is exported – almost all the oil produced in the country is immediately exported.

With high prices not only for oil but also metals, the growth of Kazakhstan’s economy is supported by the metal ore mining sector. However, according to the latest data, the growth of its production has also slowed down (+0.5% compared to last year, +1.9% in the 1st quarter of 2022). This is due to a significant drop in iron ore production by 15.5%.

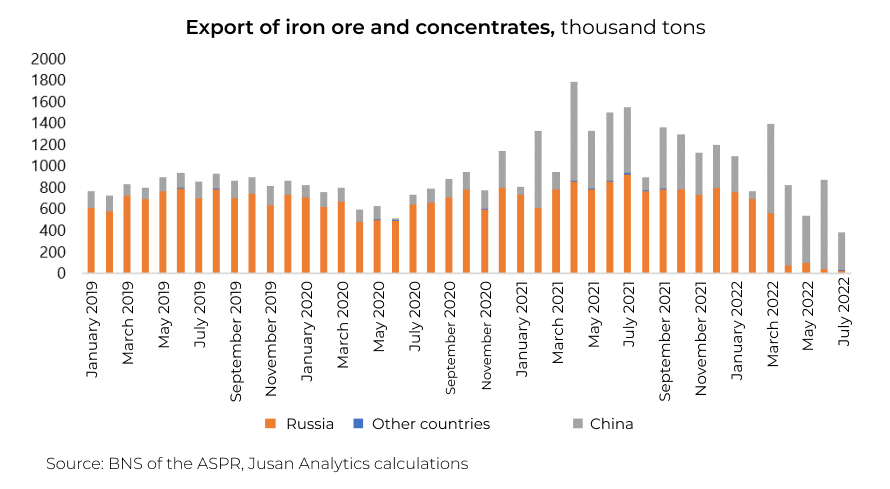

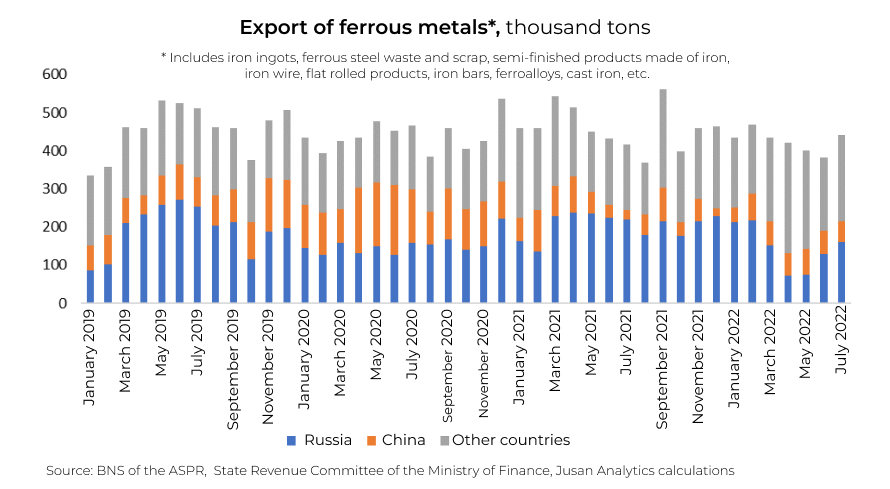

As a result of the sanctions imposed against Russia, the supply of ferrous metals, iron ores and concentrates from Kazakhstan to the Russian Federation – the main buyer of these goods, began to decline. And in our opinion, this is the reason why the iron ore mining has slowed down.

In addition to Russia, China also buys metallurgy products, which could become a new market, but many experts and world economic institutions predict a deterioration in Chinese economic growth due to their zero-tolerance policy for coronavirus. And this causes new risks for the mining industry of Kazakhstan.

Where should we move on?

The current global situation forces Kazakhstan to look for new ways of development and markets for its goods. We believe that the pressure from the external sector has once again shown that Kazakhstan should pay more attention to the development of the manufacturing sector. In our previous study on the scoring of economic sectors, it was noted that the main driver in the manufacturing industry is metallurgical production, the strengths of which were noted by criteria such as profitability, debt burden, competition with imports and operational efficiency.

Клара Сейдахметова

Клара Сейдахметова