Kazakhstan has periodically experienced shock phenomena in the consumer market in the last few years, which are expressed by a shortage and, as a result, a rapid increase in prices for various goods. For example, the situation with the sugar and the lack of diesel fuel at gas stations, especially in the spring of this year. We will also note the increase in prices for cereals, sunflower oil, building materials, and bar ferrous metals.

All these shocks have no visible prerequisites, but they are developing rapidly. Prices may exceed the base multi-year level by 2-3 times at the peak. As a rule, they do not get back to the previous level even after the imbalance eliminations that caused them.

If we consider the situation with the dependence of domestic consumption on imports, then in general it does not look alarming.

Figure 1

In Figure 1 we can see that machinery and equipment are highly dependent on imports, while food products are not that dependent. And the latter must not be highly susceptible to shocks, but they are mostly observed in this market. Perhaps the reason is that unforeseen situations in machinery and equipment market would be less noticeable than in the food market for an ordinary citizen. For example, the production of two Hyundai car models has recently been suspended in Kazakhstan: the supply of components from the Russian Federation stopped in the spring, company was working on stocks and is now trying to face up to the challenge of further deliveries and new logistics chains.

The investment goods market is less dynamic than the consumer one. However, if there is a supply dislocation or the machinery and equipment purchase volume is insufficient due to logistical, sanctions or price problems, then this will lead to a decrease in the efficiency of product manufacturing for which they initially were intended. And this, in turn, will affect the consumer market. For this reason, the analysis of the machinery and equipment supply is also important. But, most likely, the main problem with the machinery and equipment supply to Kazakhstan is the limited solvency of consumers and not a sharp shortage of any given device.

We decided to conduct an express analysis and try to understand the nature of shocks to determine the reason for regular ones in the food market. And to smooth out the differences in one particular year, we have used average data from 2016 to 2021.

We have developed a step-by-step plan as part of the analysis preparation.

Stage 1. The domestic market was divided into the following components: production, import and export by enlarged positions. And the import ratio to consumption was revealed.

We found out that several commodity markets have an import ratio from domestic consumption[1] above 100% (see Figure 2). This attests to the fact that production and import have completely different commodity nomenclature. For example, we can assume that the production of chemical products is focused on goods of “primary” chemistry (various acids and fertilizers), and mainly household chemicals, perfumes, etc. are imported.

[1] Hereinafter, domestic consumption is defined as “production + import – export”

Figure 2

Let’s stop on ferrous metallurgy products. Kazakhstan has large iron ore reserves and a large production complex in Temirtau. Kazakhstan has large iron ore reserves and a large production complex in Temirtau. The country exports a large volume of ferrous metals, but at the same time, the ratio of imports of ferrous metallurgy products is half of domestic consumption. Therefore, the production and import of ferrous metals have different commodity content as chemical products.

It should be noted that a significant volume of imports with large exports of one grouping of products is not always a negative trend. A country doesn’t have to produce everything. And such a situation can be dictated by production efficiency – the international division of labour.

Stage 2. Following the fact that imports from the EAEU countries account for about 40%, the content of these countries in the enlarged commodity groups import was determined. Since within the framework of trade in the EAEU, the largest trading partners of Kazakhstan are Russia and Belarus, so we decided to highlight trade with them. In addition, international sanctions have been imposed on them, which may affect the supply of goods from these countries.

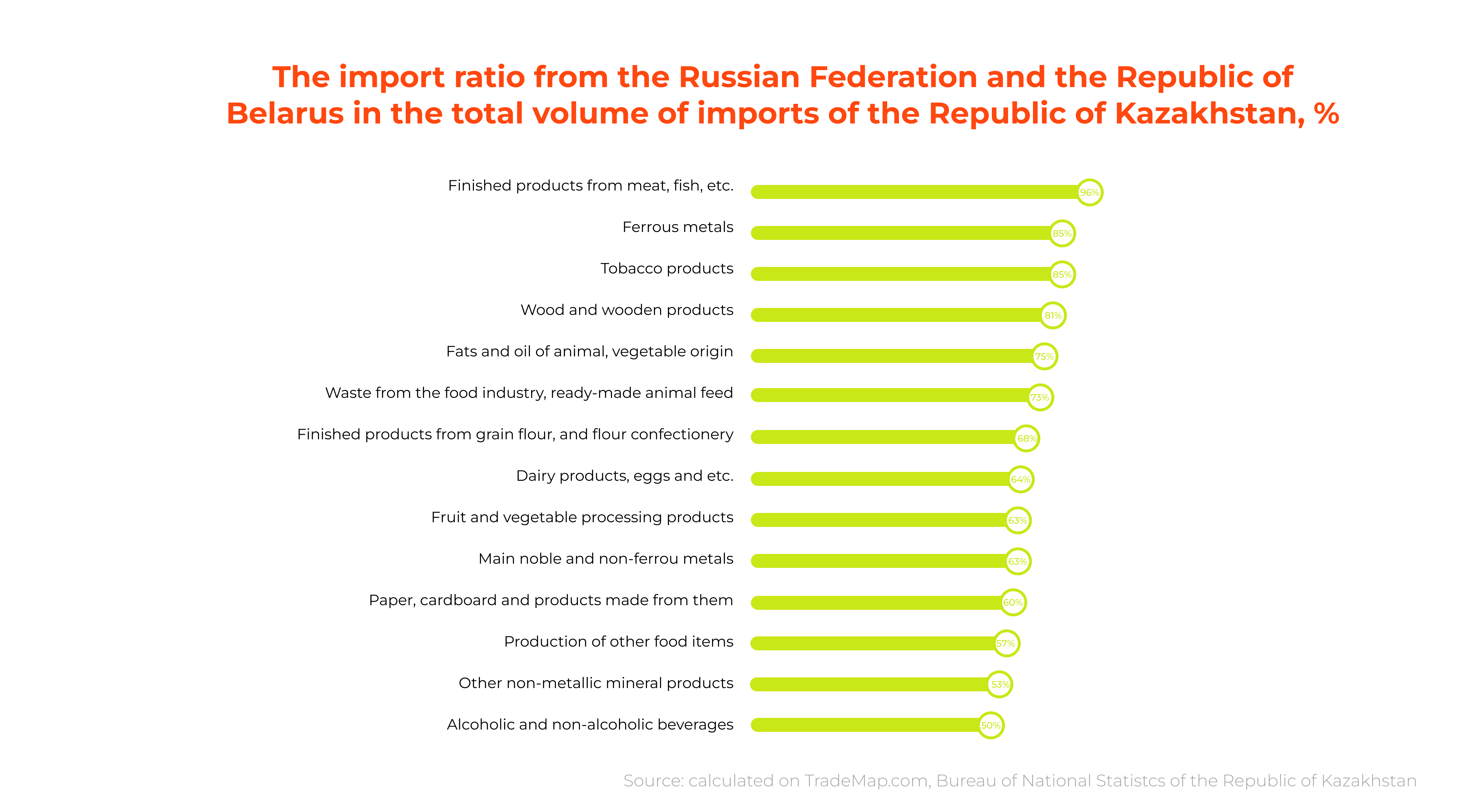

Imports from the Russian Federation and the Republic of Belarus are dominant with a ratio of 75-95% of the total volume for several commodity items (see Figure 3). They are not always large in the volume of domestic consumption or imports, but they are quite sensitive to the population. Goods from the Russian Federation and the Republic of Belarus occupy a large ratio in imports by positions related to food products.

Figure 3

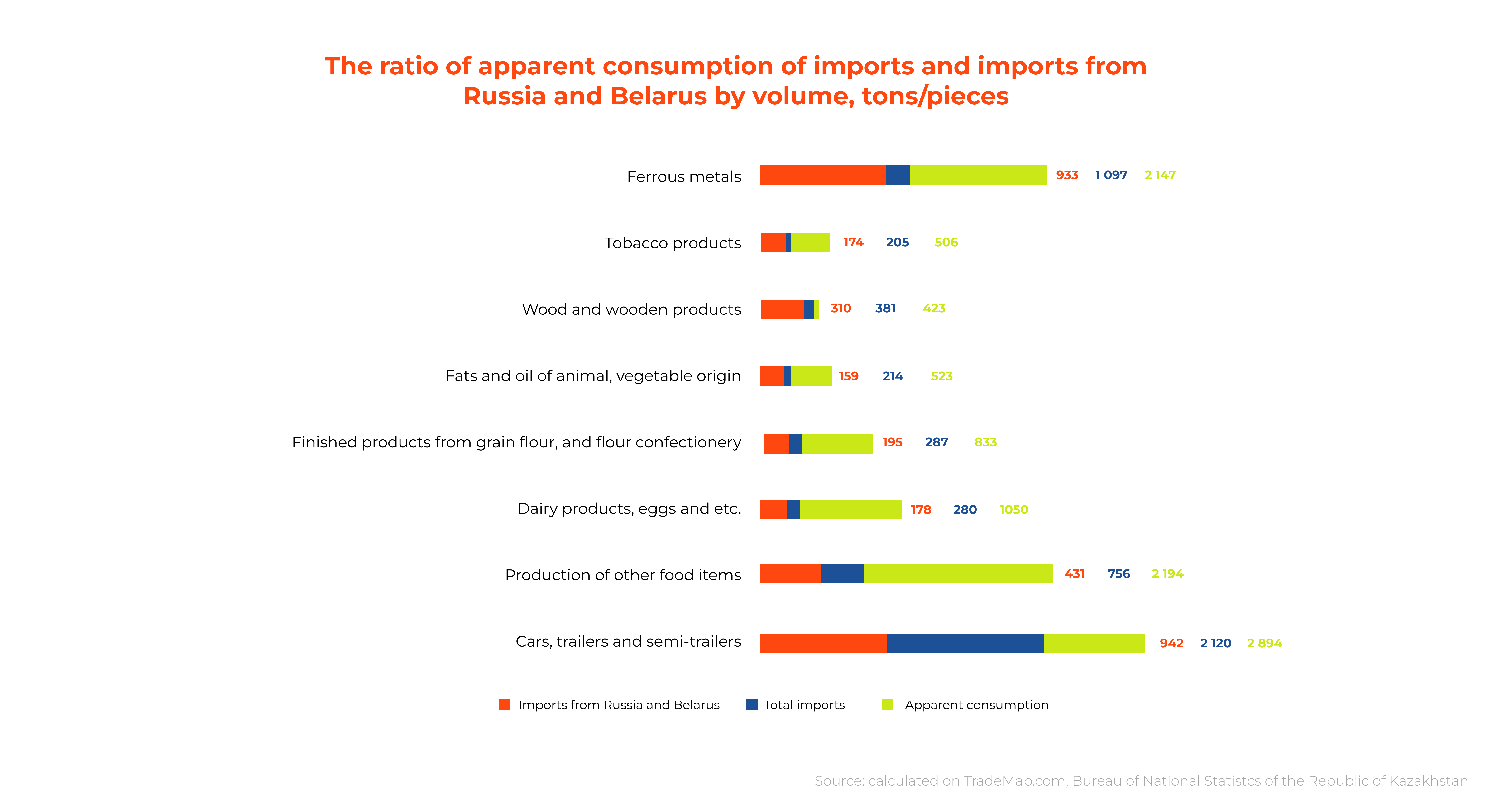

The most sensitive commodity groups from imports from the Russian Federation and the Republic of Belarus are ferrous metals, tobacco products, wood and wooden products (see Figure 4). Groups of goods were selected by which imports occupy a significant ratio in domestic consumption, and the ratio of imports from the Russian Federation and the Republic of Belarus – a large or dominant ratio. At the same time, special attention is paid to goods that are important for the consumer market.

Figure 4

Insufficient diversification of the country’s structure in imports has a more negative impact on the commodity market stability than a large ratio of imports in domestic consumption, but with a diversified country structure.

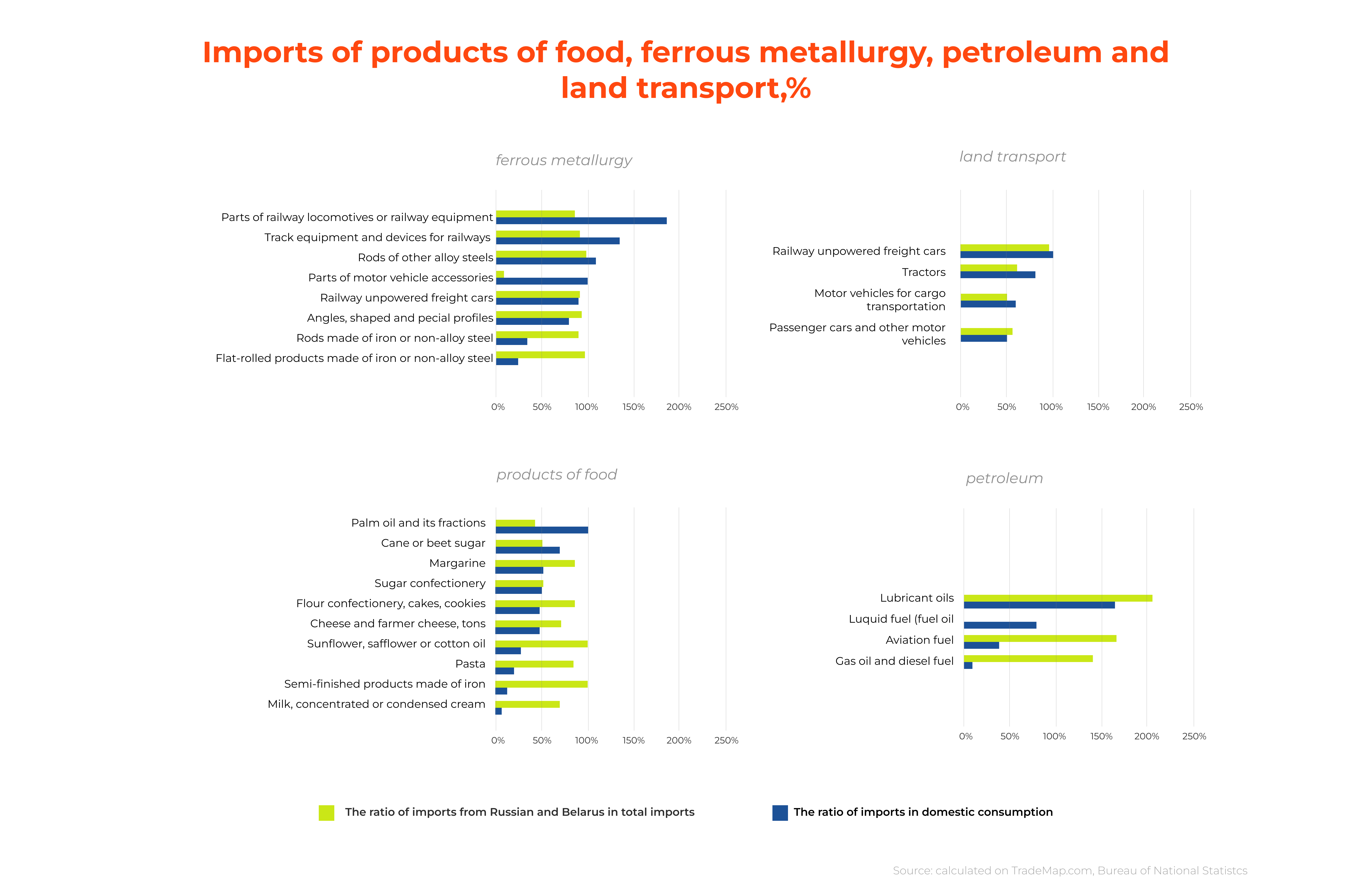

Stage 3. The positions for which the Russian Federation and the Republic of Belarus make up large ratios were divided into smaller ones (4-10 characters of the FEACN) for a detailed study of the ongoing processes. We decided to focus on food products, ferrous metallurgy products, land transport and petroleum products, where the ratio of imports from the Russian Federation and the Republic of Belarus is upping (see Figure 5).

Figure 5

Now dairy products separately. Chosen by us FEACN 0402 category includes powdered milk, which is used as an intermediate product for the production of dairy products. At the same time, the low ratio of imports in the production of dairy products is a consequence of the fact that it is difficult to choose a category for comparison. The import ratio of the Russian Federation and the Republic of Belarus in this category is extremely high and amounts to about 70%. Supply interruptions of this product group from these countries may lead to a shock in the dairy market. Due to the lack of well-established contacts and the need to rebuild logistics, it will not be possible to quickly reorient supplies from other countries. Such an event was shown vividly by the situation with sugar that has developed this year: the suspension of supplies from the Russian Federation has led to a shortage and an increase in prices, and it takes time to establish supplies from South American countries.

Conclusion. Imports of goods do not account for a high ratio of domestic consumption in all groups, but even interruptions of 20% can lead to a short-term shock in the market with all the consequential effects. This is due to the high concentration of a small number of supplier countries.

The most import-dependent commodity groups are food products (various oils for food, confectionery, flour and pasta products), dairy products and certain groups of petroleum products (lubricant oils). Shock situations may also arise in the markets of rolled ferrous metal products (fittings, angles, profiles, etc.), which are used in construction, automotive markets and their components, as well as in the supply of railway wagons and equipment for the railway.

An important disclaimer! This conclusion is based only on a comparison of factors and retrospect. We are not calling for or confirm that a crisis will happen. We only point out that there is a significant dependence on the consumption of individual goods from imports following the analysis.

It is fair to say that the current mono-country structure is a normal course of the market situation. Duty-free trade and simpler logistics have reoriented trade in some goods to the Russian Federation and the Republic of Belarus, displacing other suppliers. The same situation has developed in the EU countries, where the main trading partners are the countries of the community.

Тимур Дауранов

Тимур Дауранов