Sugar production briefs

The main raw materials for sugar production in the world can be called sugar cane and sugar beet. These cultures have approximately the same sugar content and amounts to 16-20%. Sugar beet is grown in 62 countries in the world, the main manufacturers are European countries and Russia is the leader. Sugar cane is grown in 94 countries of the world, the main manufacturers are countries of subtropical climate, the leader is Brazil. The global production of sugar cane exceeds the production of sugar beet by almost 7 times.

At the same time, all sugar production is distributed as follows: 80% from sugar cane and 20% from sugar beet. The reason for this difference consists in the methods of cultivation and processing.

Sugar cane is a perennial plant that can be harvested all year round. But it must be processed within a few hours after its harvest. For this reason, the factories are located in close proximity to the plantations.

Sugar beet has a seasonal harvest and a limited keeping period. Accordingly, processing plants operate at full capacity during the harvest season. The rest of the time, the plants are idle or process raw sugar.

Sugar production in Kazakhstan

Domestic sugar production can be divided into following two categories:

- from own raw materials – the sugar beet harvest is 460-500 thousand tons, of which 50-75 thousand tons of sugar are obtained.

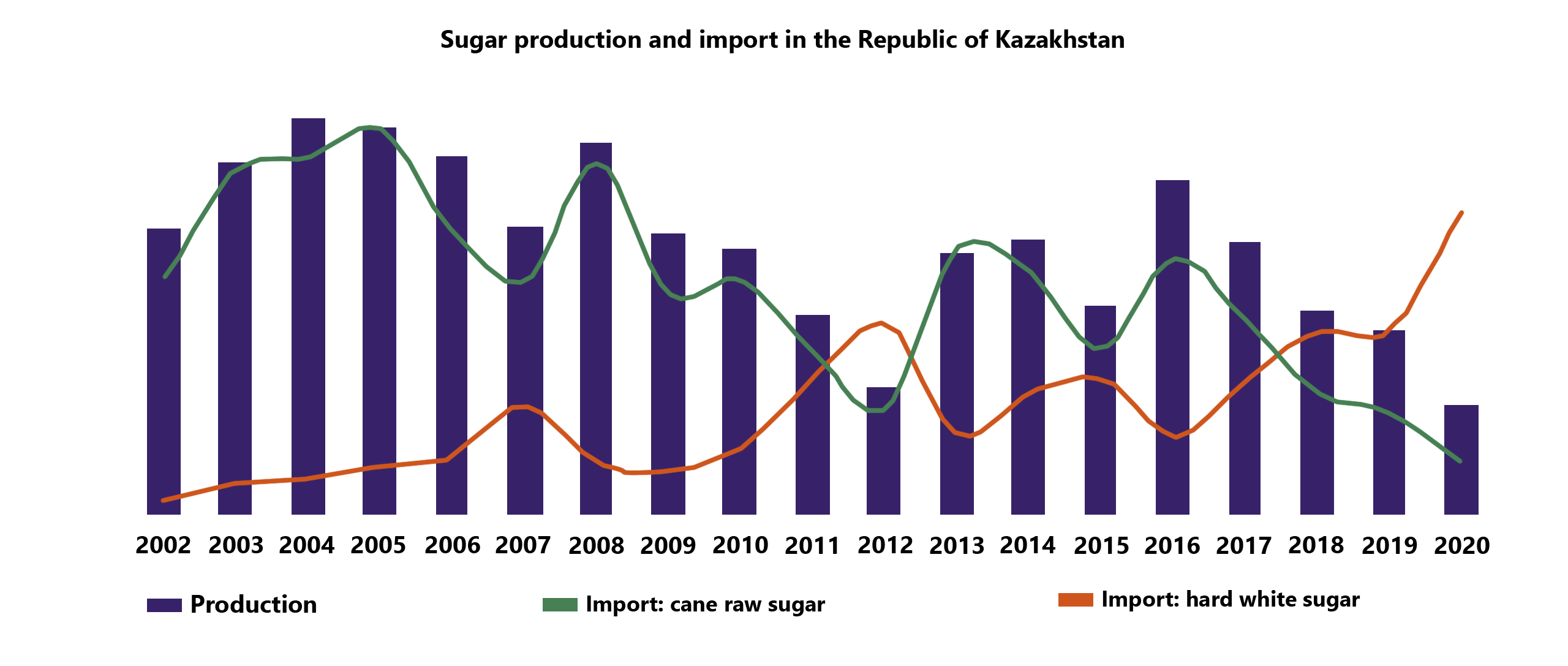

- from imported raw sugar – production in various periods amounted to 250-400 thousand tons. This method of production was the main one in Kazakhstan until 2016.

Domestic sugar consumption is estimated at 500-550 thousand tons annually. At the end of 2020, the refining capacity for cane raw sugar was 360 thousand tons, for beet sugar – 83 thousand tons.

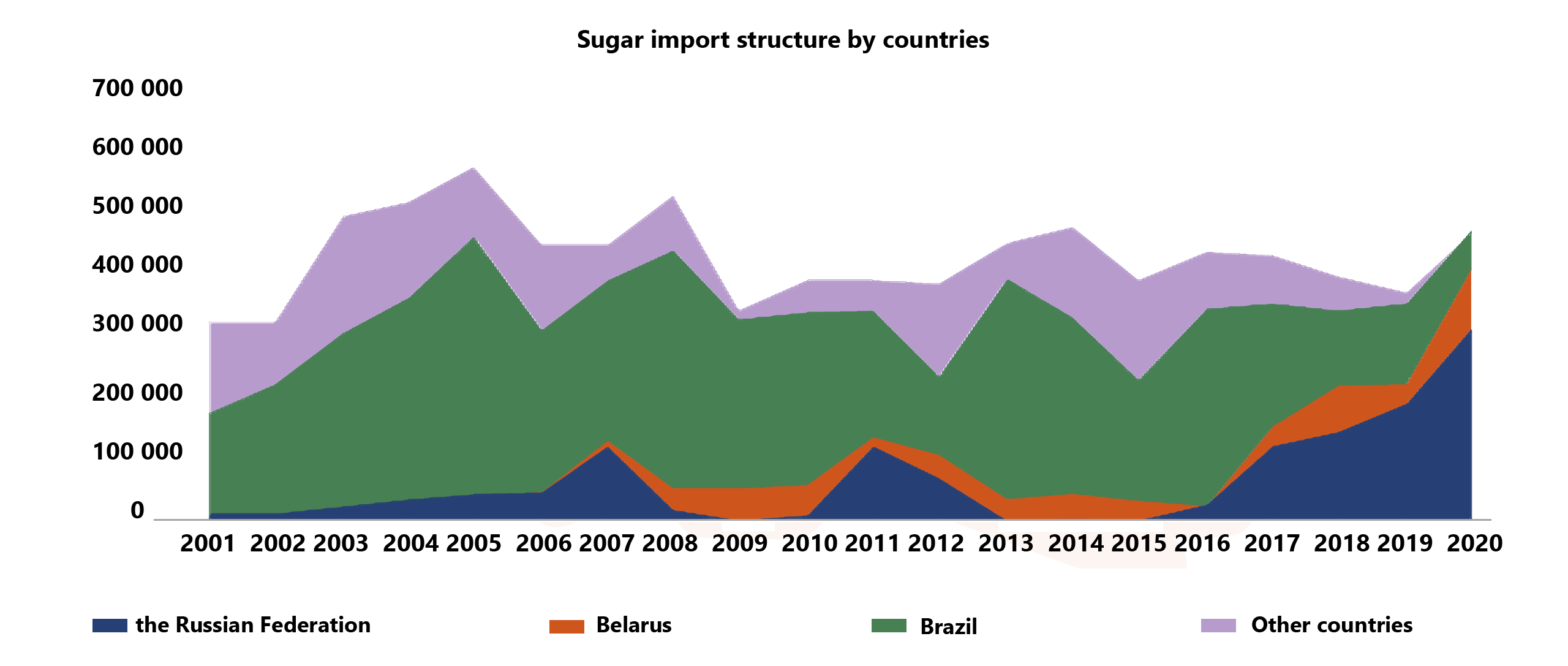

The main part of consumption is satisfied by imports. For quite a long time, domestic plants had been bought cane raw sugar as a raw material. However, since 2016 imports of finished products have began to grow, and domestic production began to decline. As a result, we have faced with a shortage of local raw materials and a reduction of imported ones.

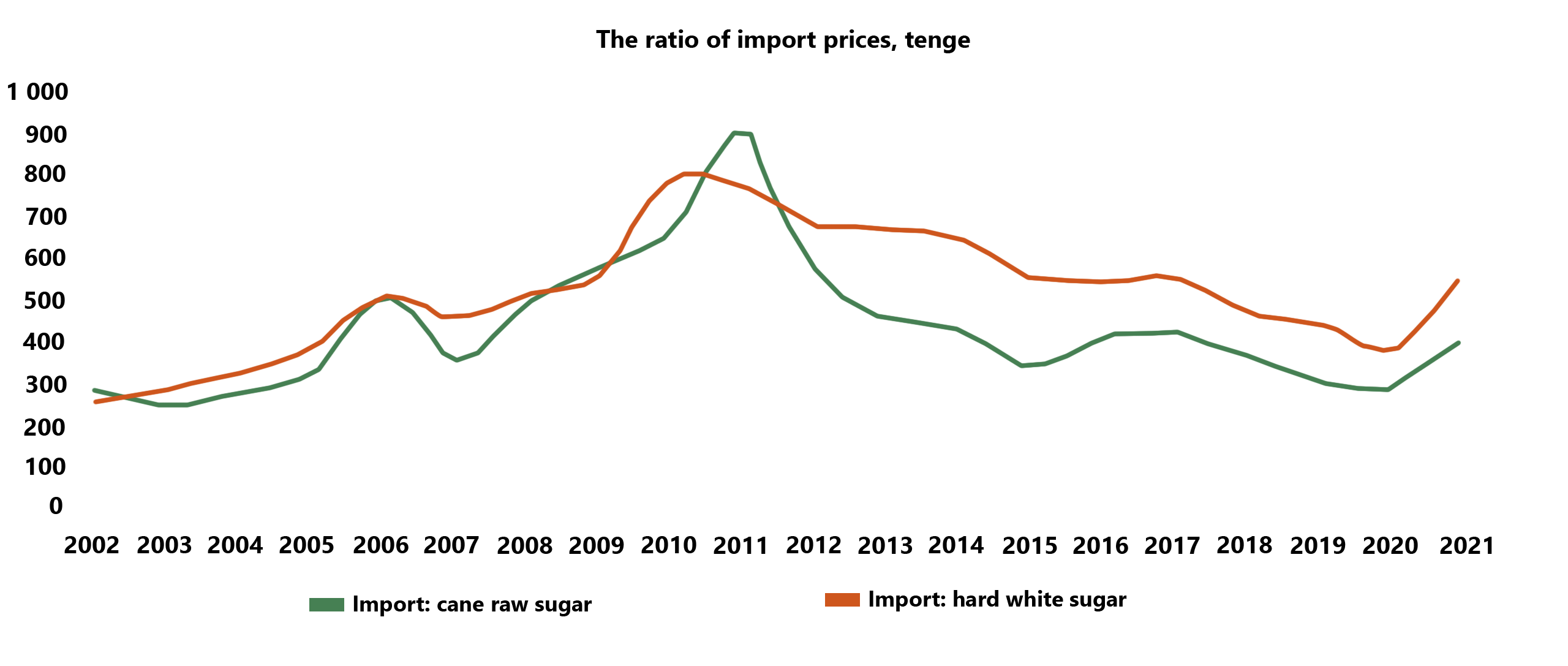

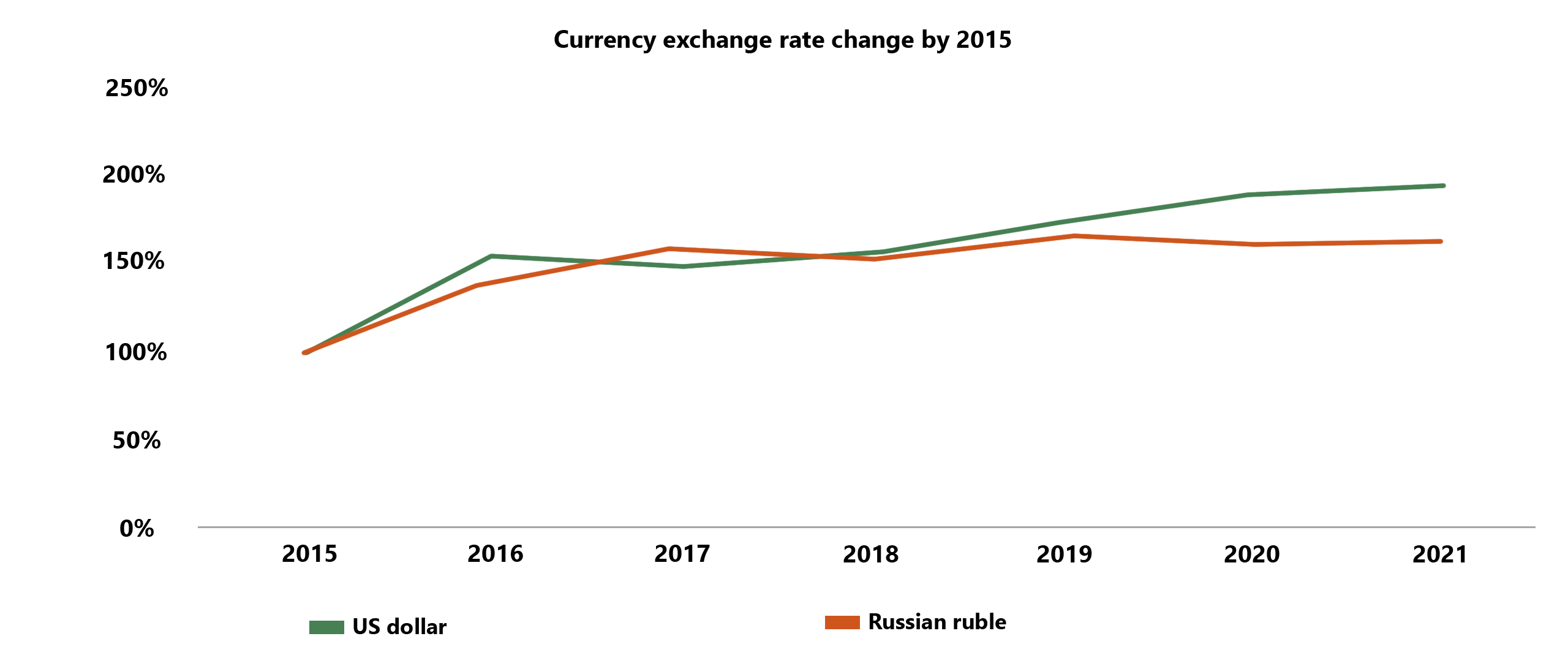

Kazakhstan buys cane raw sugar from Brazil for the US dollar, while refined sugar is mainly bought from Russia and, most likely, for rubles (about 70% of imports from Russia are carried out for rubles). But raw sugar still needs to be processed, spending additional money and time, and the refined sugar is ready to sale.

The reduction in the price difference between raw sugar and refined sugar, given the historically more stable exchange rate of tenge against the ruble, has led to a significant increase in imports of refined sugar.

Thus, the current situation with sugar shortage in Kazakhstan is caused by the following factors:

- sugar release from its own raw materials covers the needs of only 10%;

- insignificant volume of raw sugar supply for further processing. Since 2016 imports have been steadily declining;

- high dependence on imports of refined sugar from Russia. Sugar has come under state regulation in Russia and it is necessary to obtain a special permit for its export.

Since the main producing countries are located on the American continent, it is problematic to quickly increase the supply of raw materials for processing. All other things being equall, shipping by sea may take several months.

What will happen next?

Recently, on the website of the Eurasian Economic Commission (EEC) have appeared a message on the decision to provide tariff preferences in the form of duty-free sugar import in the period up to August 31, 2022. Sugar imported to the Republic of Armenia in the amount of no more than 60 thousand tons, to the Republic of Belarus – in the amount of no more than 100 thousand tons, to the Republic of Kazakhstan – in the amount of no more than 250 thousand tons, to the Kyrgyz Republic – in the amount of no more than 70 thousand tons, to the Russian Federation – in the volume is not more than 300 thousand tons is exempt from import customs duty.

This measure may temporarily resolve the issue of filling the domestic market of the EAEU countries with sugar and as part of the reorientation of imports will allow concluding contracts for the supply of raw sugar in a more peaceful atmosphere. However, within 2-3 weeks, the situation with sugar will still be hot-button issue, because its supply still needs to be adjusted, and the production capacities of domestic plants need to be increased.

Тимур Дауранов

Тимур Дауранов