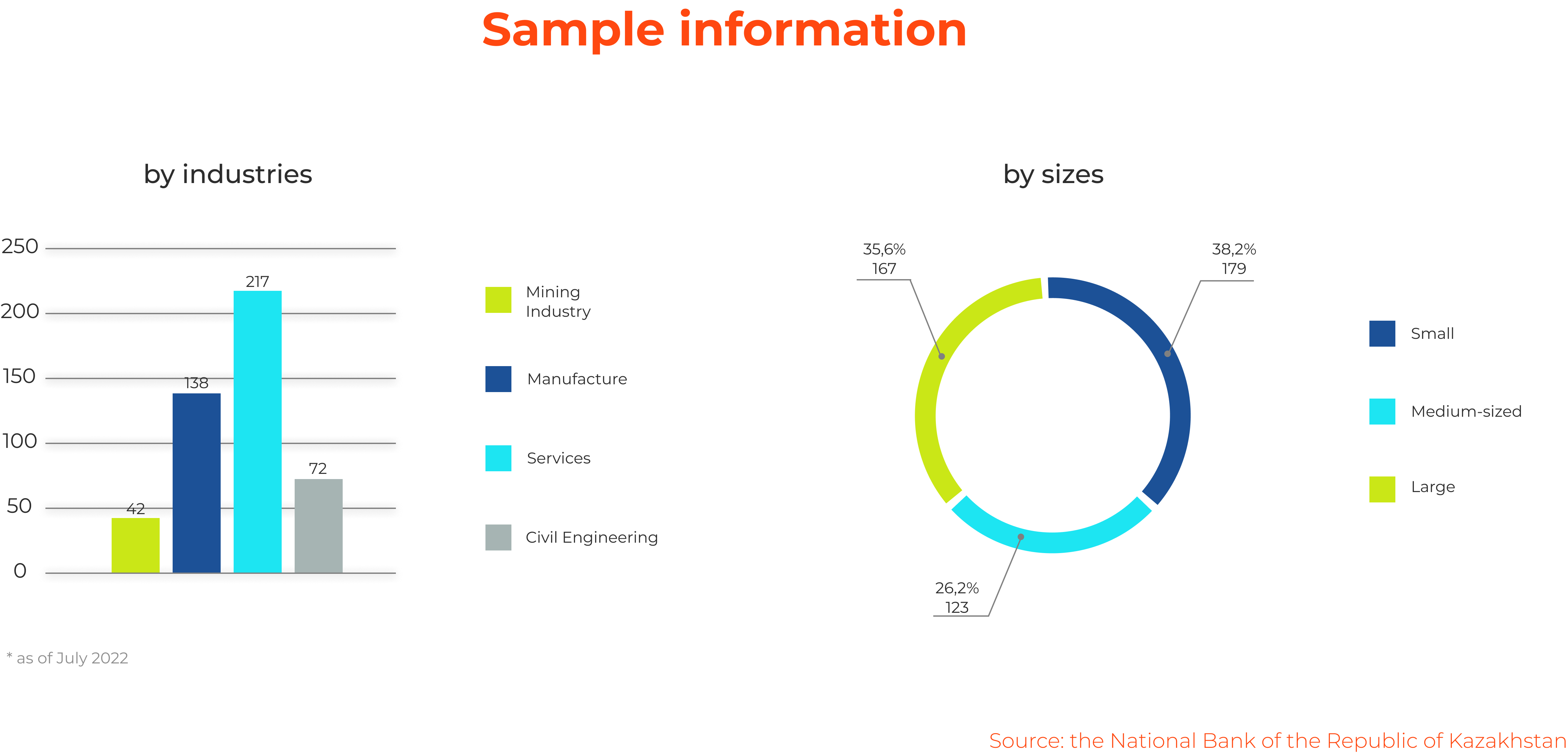

The National Bank of the Republic of Kazakhstan (NBRK) issues a monthly report on the business activity state in Kazakhstan. The National Bank of the Republic of Kazakhstan evaluates business activity using indices calculated based on the results of a survey of enterprises participating in the monitoring of the real sector. As a rule, the sample includes more than 450 enterprises associated with key sectors of the country’s economy, including rendering services, mining and manufacturing sectors. In July of this year, 469 companies participated in the study. The sample includes all sizes of enterprises – small (179), medium-sized (123) and large (167).

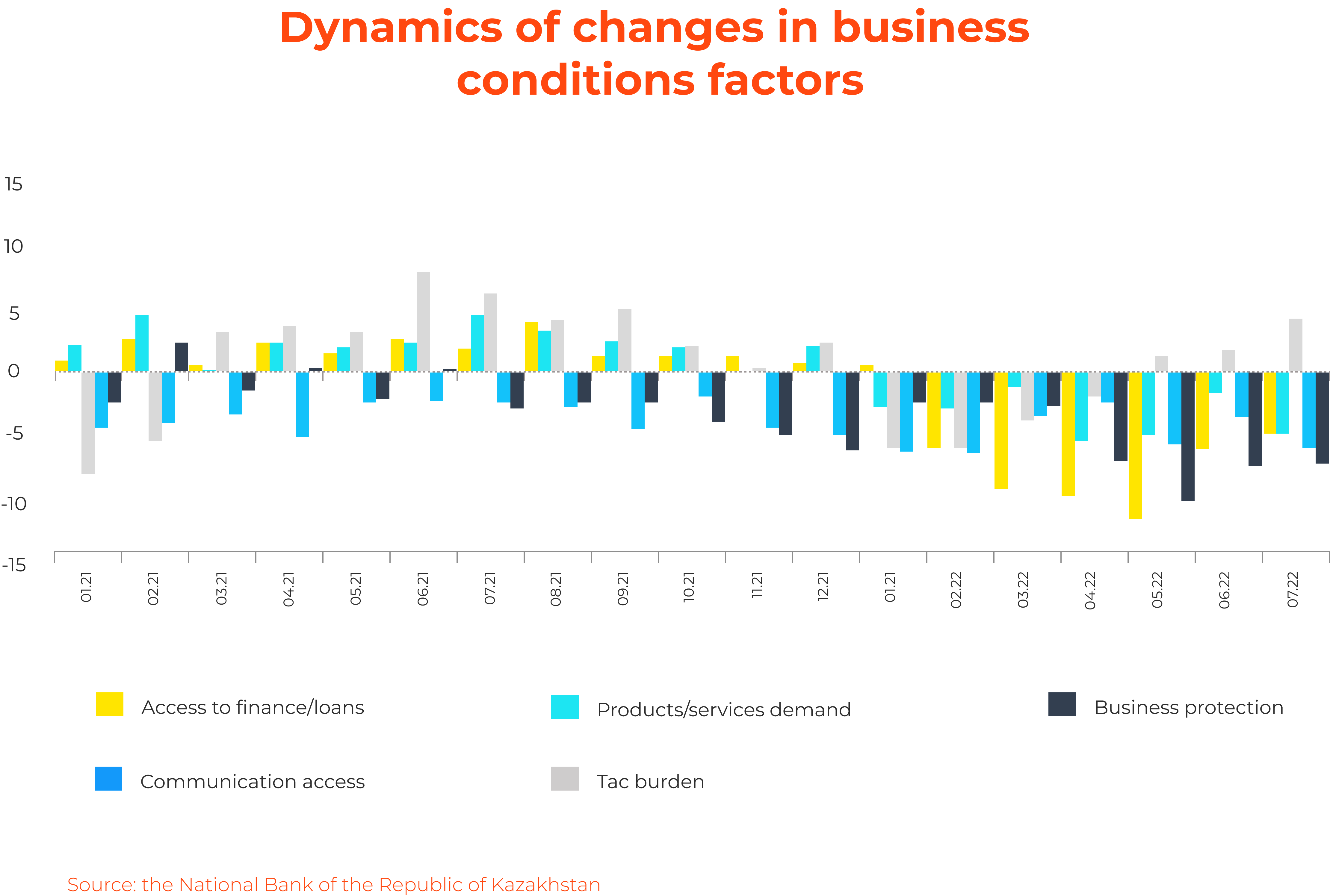

One of the key indicators in this report is the Business Factors Assessment. For each of the factors is calculated its own one, and a total of 5 following factors are determined:

- access to finance/loans,

- communication access,

- products/services demand,

- tax burden,

- business protection.

An index value above 0 indicates an improvement in the business factor, and below 0 – a deterioration in the situation.

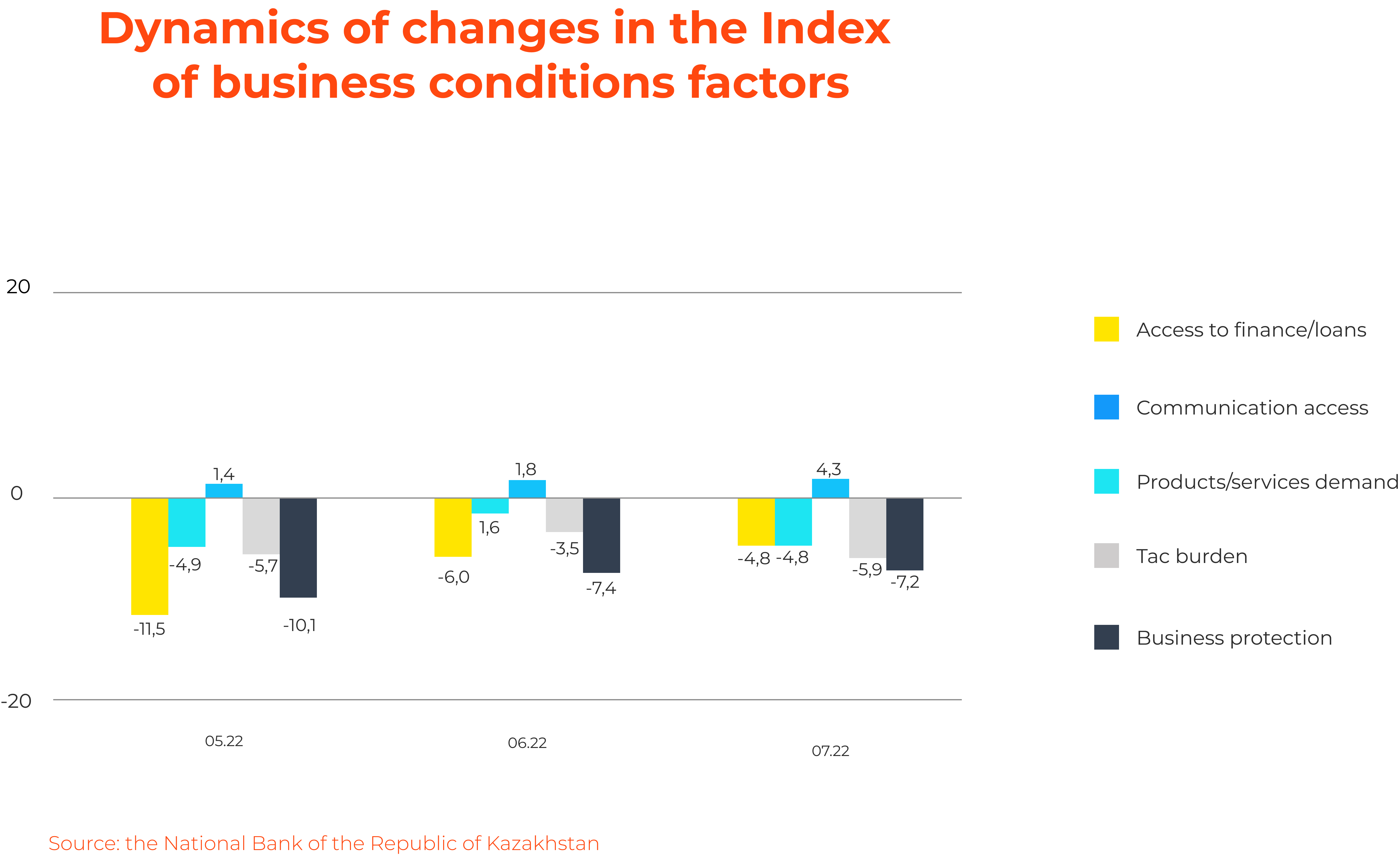

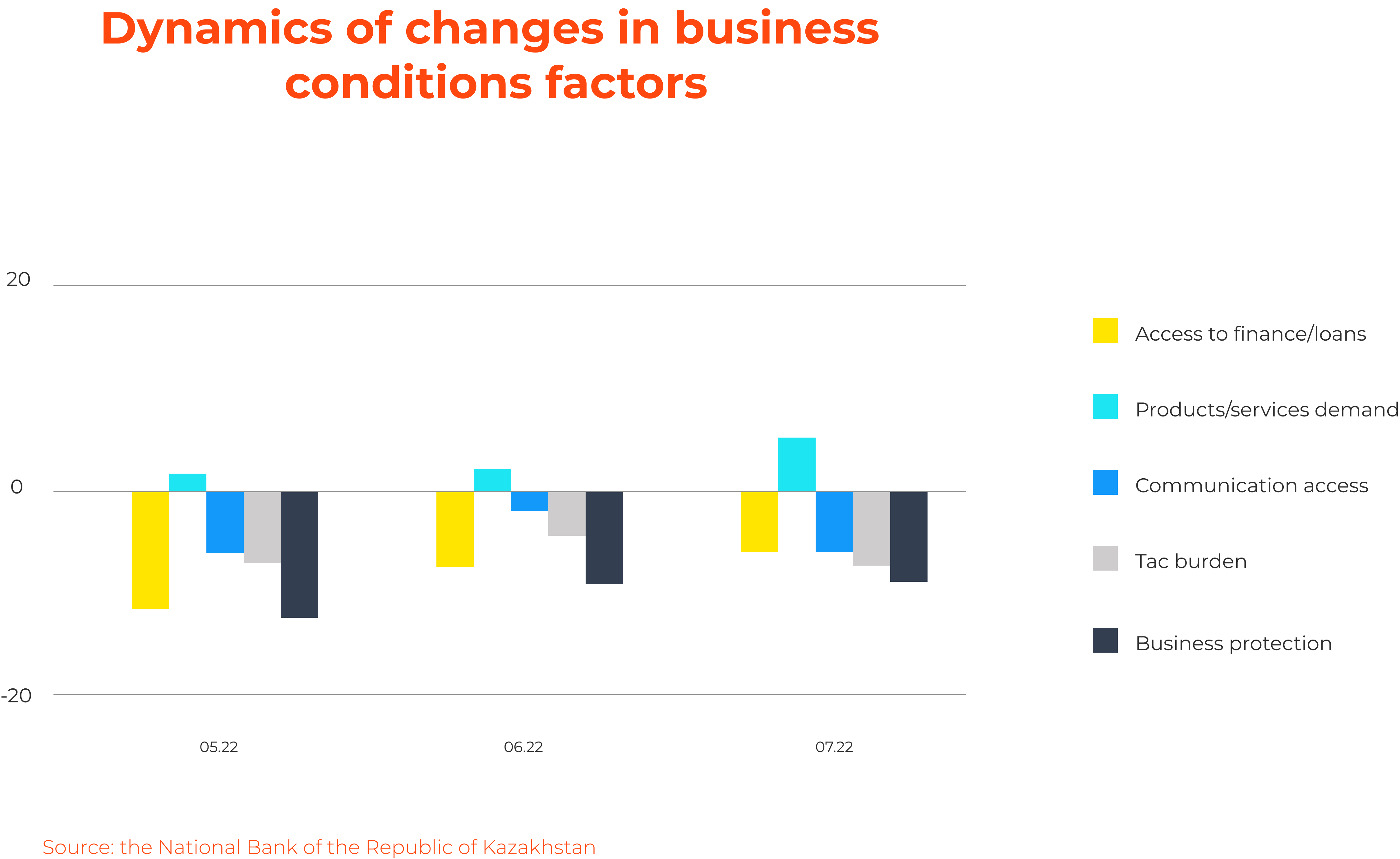

From May to July 2022, only the assessment of the increase in product demand showed a positive result. Thus, the Index value of the factor increased by 2.9 points. Other factors remained in the negative zone, and all of them, except for the tax burden factor (a 0.2 p.p. deterioration), showed an improvement in positions.

The computation of business activity indices is a significant initiative of the NBRK. They provide the necessary information to assess the business environment, as well as help businesses navigate market conditions more effectively.

According to our assessment, the factors of business conditions used by the NBRK reflect radically different directions. Thus, the factors of products/services demand and access to finance /loans reflect a direct effect on the conditions of the business environment and the state of the economy, and the rest – an indirect effect on the general business conditions with a significant bias in qualitative assessment.

Taking into account indirect factors with direct ones can lead to rather mixed results and conclusions, overestimating the final result despite of the direct economic factors of business activity or, on the contrary, underestimating it.

Factors with an indirect effect contain a sufficiently high influence lag on the business environment, and it is impossible to perceive them simultaneously and evaluate the result “here and now”. This is because changes in their conditions require the participation of several institutions, the formation or modification of certain draft bills, reforms, and therefore a certain time.

Therefore, the addition of indirect factors, especially in the framework of active institutional transformations or requests from society, will shift the assessment of the helicopter view of the business environment towards the negative. Also, these factors have much more subjectivity and they are greatly influenced by the general media coverage in the country, unlike direct economic ones.

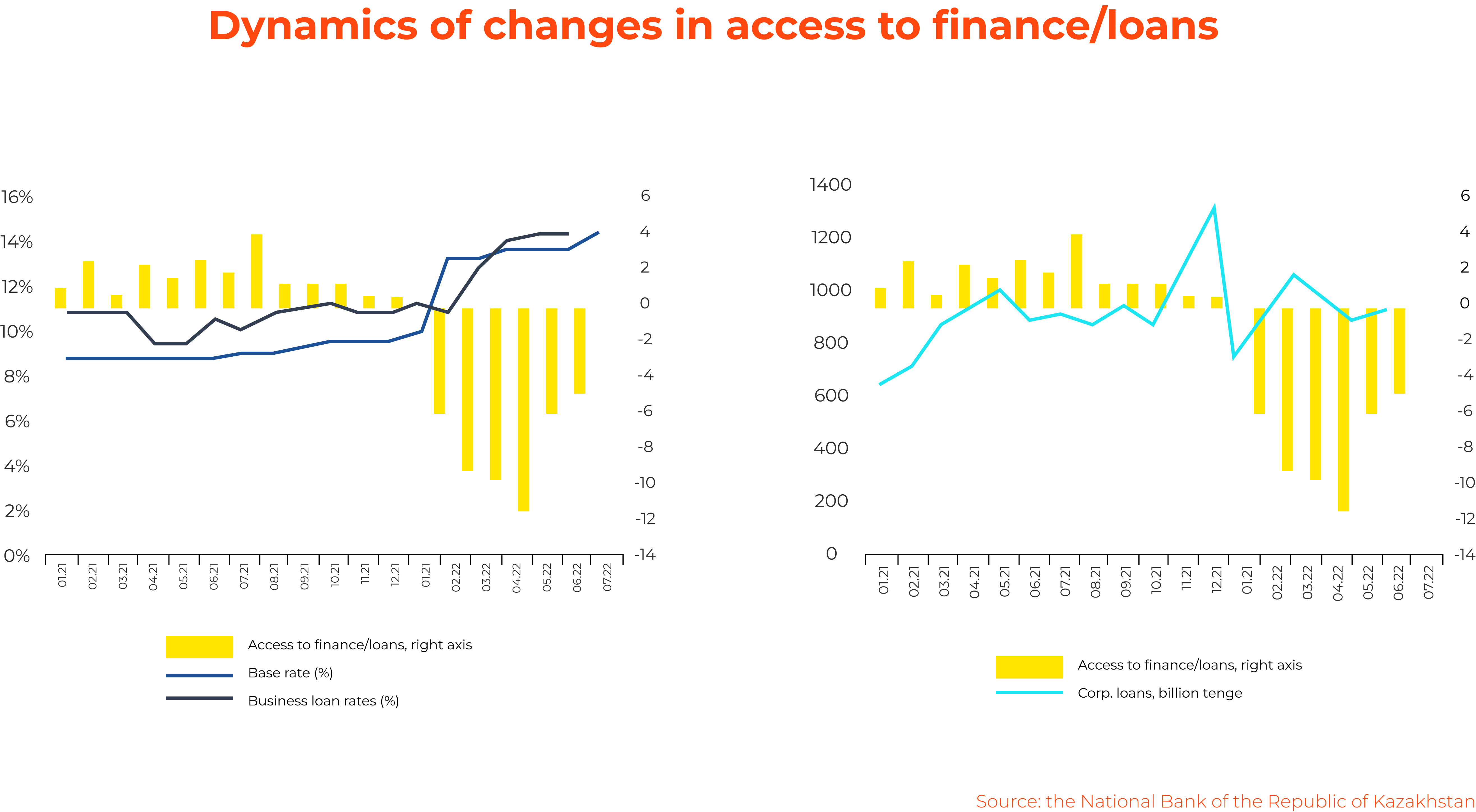

For direct factors – access to finance/credit and demand for products/services – we have identified several parameters that affect their dynamics. Access to finance/loans directly depends on the increase in the base rate due to the rise in the cost of business loans. The dynamics also indicate that after the increase in the base rate and the initial monetary shock, market participants experience an improvement in the perception of the availability of credit financing, although there has been no reduction in loan rates. So, after a sharp increase in the base rate in February of this year by 3.25 p.p. market participants experienced a deterioration in the perception of credit availability. But already in June, the Index of this factor was -4.8 points, which is 1.1 p.p. more than in February 2022.

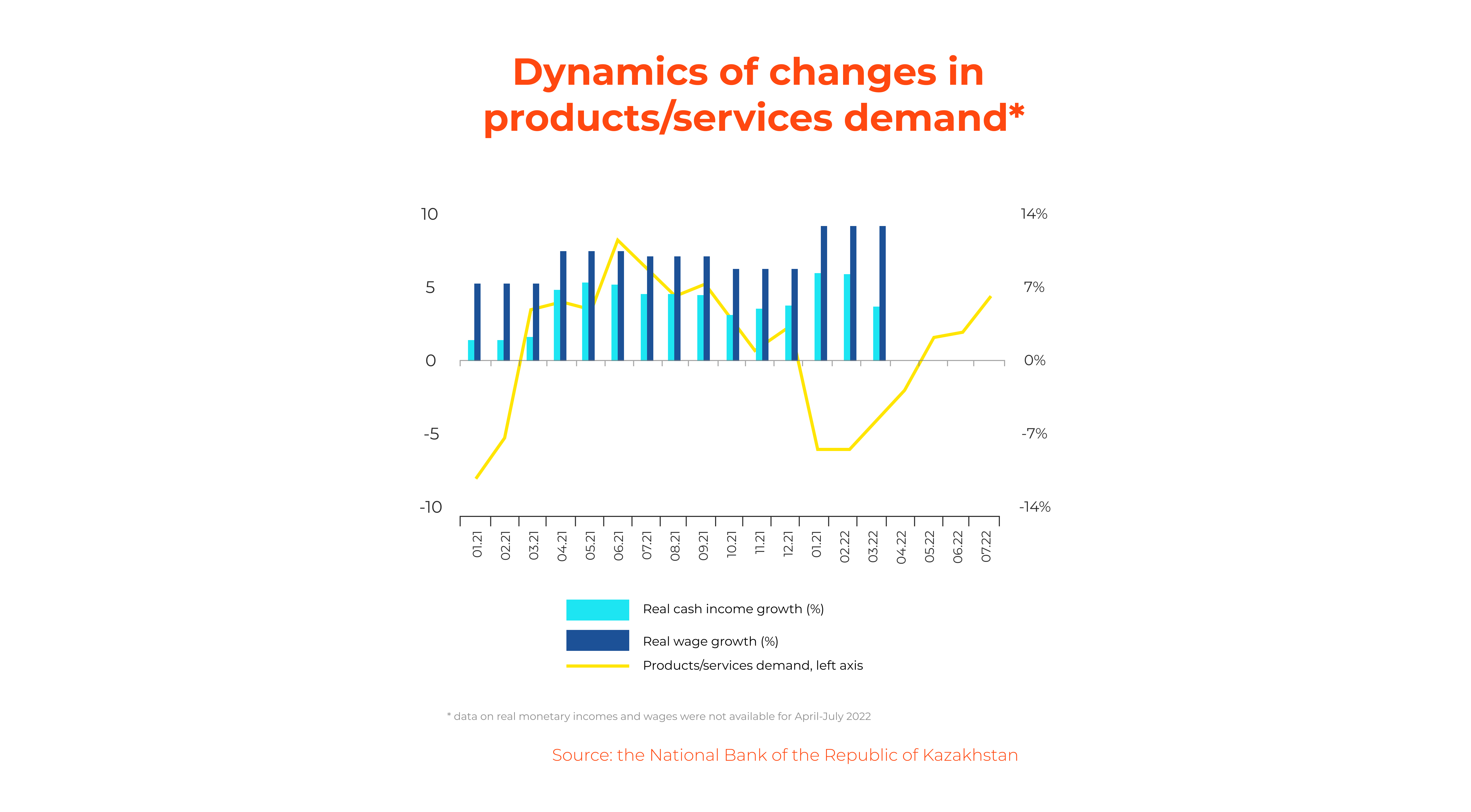

The factor of products/services demand mainly depends on the increase in real cash income. The decline in correlation was noted only during the “January events” and the acute phase of the sanctions blockade of the Russian Federation. As a result, there is a significant extrapolation and hypertrophied assessment of certain events contrary to real macroeconomic data. So, from January to March 2022, the increase in real incomes was positive. At the same time, the participants assessed the reduction in demand for their final products/services, where, most likely, there are more problems of interaction and trade with the Russian Federation. We expect that in the absence of unforeseen economic shocks, the correlation between the “demand for products” factor and the corresponding parameters will remain, which means its further increase.

Thus, despite the shift from the growth zone to the recovery zone (deterioration) declared by the final Index of business conditions, we note that the main economic factors of direct influence (the dominant value for business activity) demonstrate strong growth, and therefore business conditions still correspond to the phase of economic growth/boom.

Каиржан Алдабергенов

Каиржан Алдабергенов