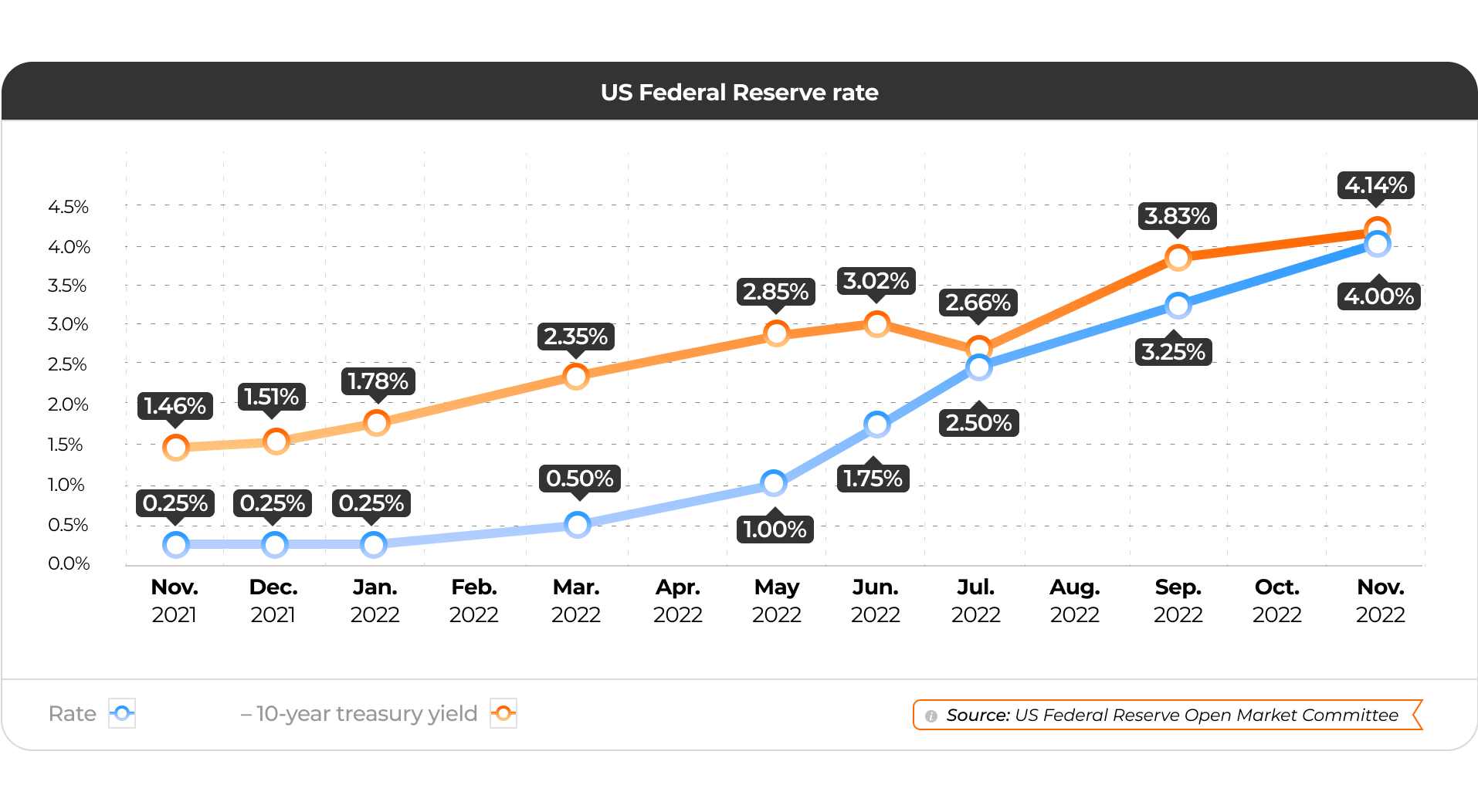

Since the end of the previous year, the US Federal Reserve policy has changed from stimulating to restraining, as the geopolitical and economic situation in the world continued to deteriorate contrary to all the forecasts given by the FOMC and global research organizations. The situation was aggravated by the conflict between Russia and Ukraine, which also increased the risk of a global recession.

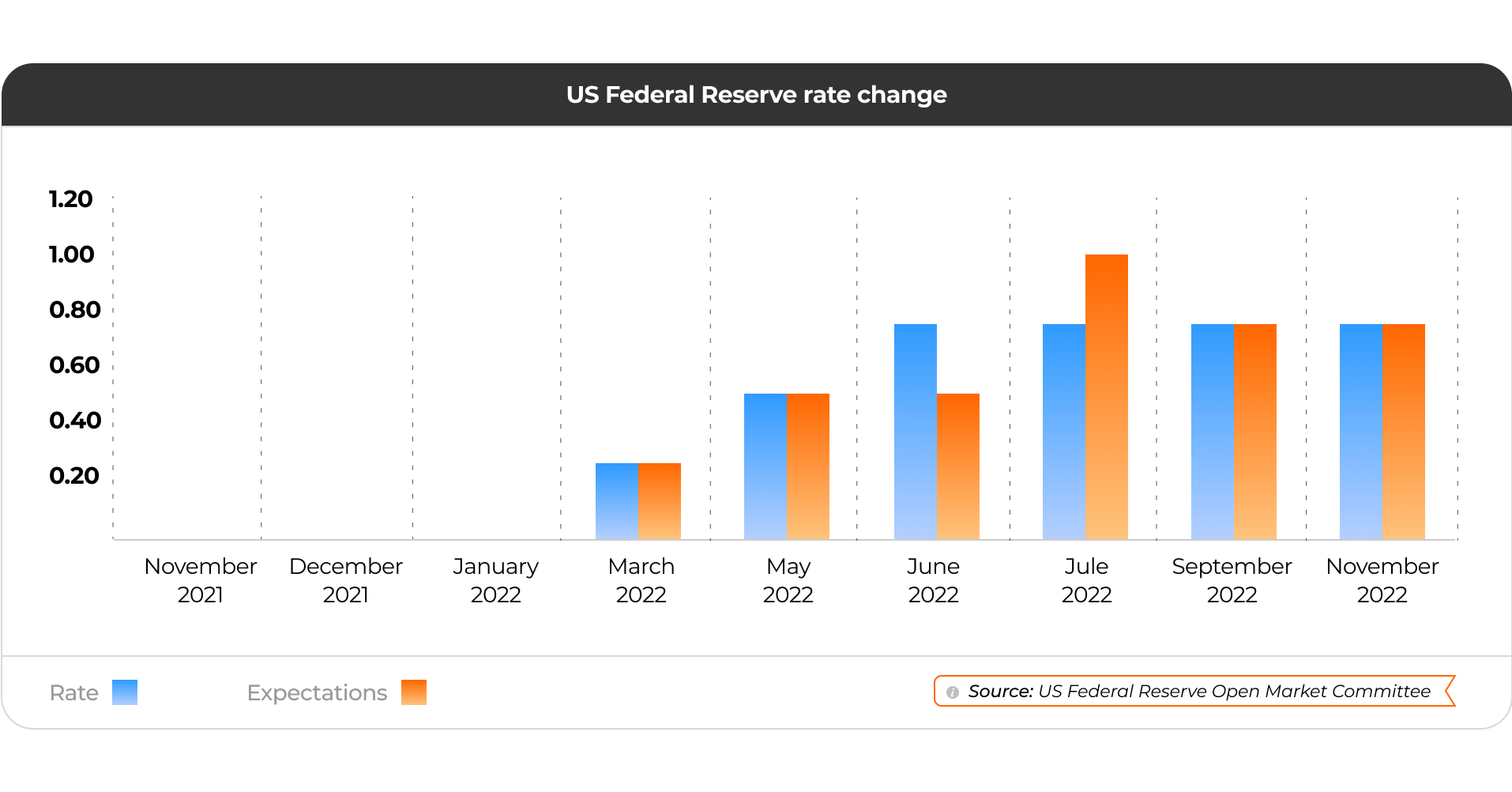

J. Powell said in his last speech that the US Federal Reserve was not going to lower the rate, but would raise it to reach the 4-5% corridor. So far, the Fed’s rhetoric says that inflation should be curbed even at the cost of short-term drawdowns in the economy. At the same time, we note that during this year the Fed’s rhetoric has changed dramatically and current statements in some moments contradict the past. And this may indicate both an extremely strong degree of variability of economic factors and the presence of significant uncertainty that does not allow forming clear forecasts and expectations.

| Date of the meeting | Fed decision |

| 11/01/21 | The Fed decides to remain the rate unchanged from September 2021 to support the economy. Particularly, to restore it after the pandemic and reduce the unemployment rate till the labour market reaches full employment and the inflation target of 2% to stabilize prices. Quote: “If we see inflation persisting at high levels longer than expected, then we will adjust the policy. I don’t think it’s time to raise rates.” |

| 12/15/21 | The Fed decides to stimulate the economy and not to raise the rate despite rising inflation. The main goal remains to maximize the employment rate in the labour market and price stability. Quote: “The inflation is no longer temporary. The rate will be raised only when the stimulus ends.” |

| 01/26/22 | The Fed keeps the rate unchanged but announces its imminent increase. Quote: “The situation with inflation is slightly worse than in December 2021. It’s also frustrating to see the bottlenecks and supply chain problems not getting better, but someday inflation will decrease.” |

| 03/16/22 | The Fed raises the rate. According to the Fed, this measure was inevitable and justified due to rising inflation. Quote: “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee expects inflation to be back to 2% and the labor market to remain strong with an appropriate approach to monetary policy.” |

| 05/04/22 | The Fed hikes the interest rate by 0.75 percentage points. In its release, the US regulator indicates that the balance sheet will be reduced until the Committee decides that the remaining reserves are at a sufficient level. Quote: “The sharp rise in oil prices and the COVID-19 lockdowns in some regions of China cause an inflation increase in the United States … The Committee believed that an additional increase of 50 basis points should be considered at the next couple of meetings” |

| 06/15/22 | The Fed continues to follow the planned course: to combat inflation and achieve a maximum employment rate, it raises the rate and reduces the balance sheet. Quote: “The Fed’s stated objective is to achieve maximum employment and inflation at the rate of 2% over the long run.” |

| 07/27/22 | The Fed is raising the rate to combat inflation and reduce unemployment. In addition, the Federal Reserve announced that the rate still has not risen that much to support the economy and avoid inflation. Quote: “We must reduce inflation. Another rate hike may be appropriate, it depends on the data. We will ask whether a tough policy is enough to bring inflation back to the target” |

| 09/21/22 | The Fed raises the rate again, up 0.75 percentage points. The US regulator decisions and market expectations are still determined by inflation statistics. Quote: “We predicted that inflation would begin to decline mostly due to the recovery of supply chains. This issue has indeed started to improve, but inflation has not shown signs of decreasing. And that is why we decided to continue the policy of raising the rate” |

| 11/02/22 | The Fed has raised the interest rate by 75 basis points for the fourth straight. At the same time, the rate remains below inflation: 4% against 8.2% inflation. And in the EU the situation is worse since its rate is 2%, and inflation is 10.7%. Quote: “We believed and thought that everything was under control, but we were wrong … It’s too early to think about any pauses” |

Жадыра Байгельдинова

Жадыра Байгельдинова