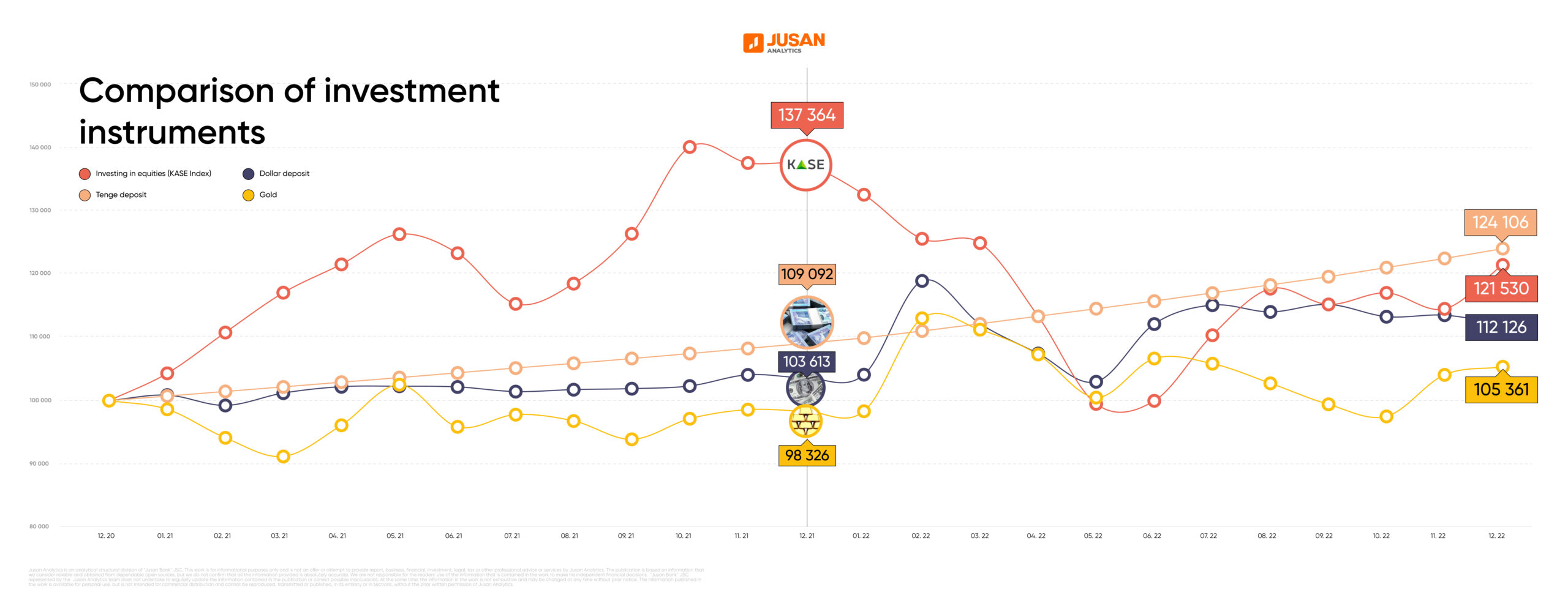

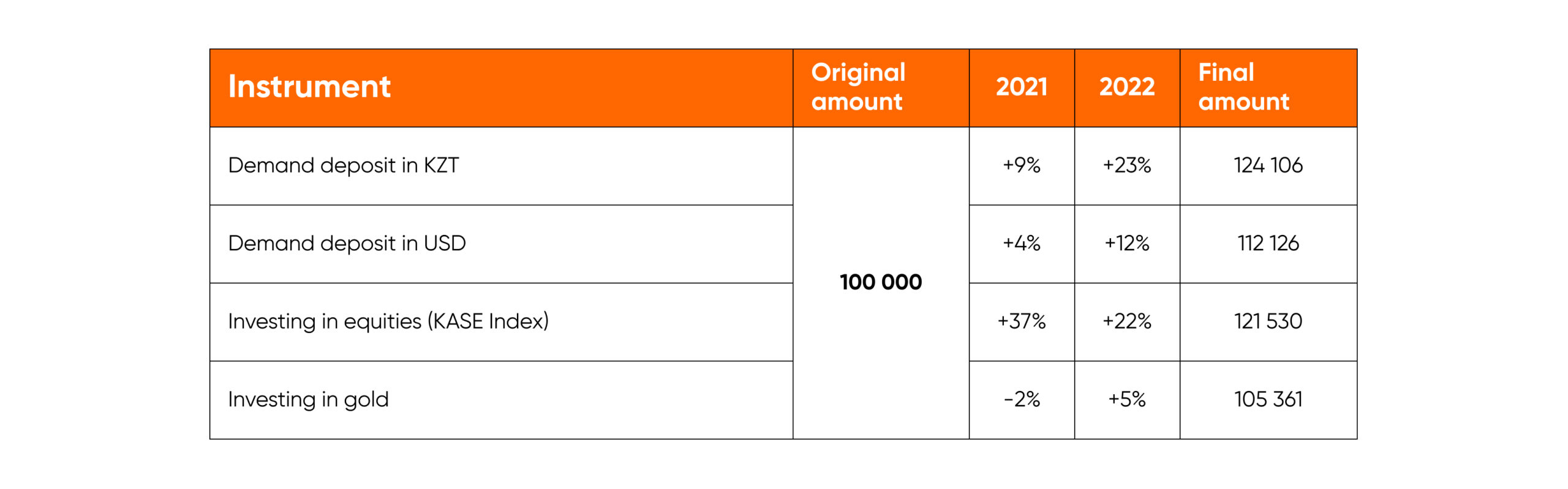

Let’s imagine that we have spare 100,000 tenge at the end of 2020, and we decide to invest them. The following investment types are available: opening a deposit, share purchases and investing in gold. Let’s analyze and see which option is more profitable when placing money for 2 years.

Let’s start with the classic type of investment – a deposit. It can be opened both in the national currency and in a foreign one. Demand deposits are popular among Kazakhstan citizens, and can be constantly topped up and partially withdrawn, mainly without loss of interest. And we will consider them.

So, we place 100,000 tenge in a demand tenge deposit at the end of 2020 at 9% per annum. Recall that banks periodically review the remuneration rate, focusing on the maximum recommended ones set by the guarantee fund. If the latter change upward, then banks can automatically increase their rates for all customers at their discretion.

Thus, deposits would have increased by 9,092 tenge over the year due to interest rate increases from November 1, 2021 to 9.3%. By the end of 2022, the deposit amount would have amounted to 124,106 tenge, while the recommended rates for this type of deposit for the year changed upward 7 times and from December 6, 2022 were equal to 16.3%.

Despite the weakening of the national currency, dollar deposits are still less profitable and attractive for investments. For 2 years, taking into account the exchange rate revaluation, the yield would be 112,126 tenge. This means that the profit from such placement is 2 times lower than that of tenge deposits.

Investing in equities is a good option for placing free funds, but it is riskier among the instruments we have chosen. For your convenience, we have considered investing in domestic blue-chip stocks based on the KASE Index dynamics. The yield would have been 31% at the end of 2021, but under the sway of external and internal shocks, the Index decreased by 12% in 2022. And as a result, the total return would be 22%, and the amount on the investment account would be 121,530 tenge. This is slightly lower than the results from opening a demand tenge deposit.

According to our analysis, a less profitable tool is investing in gold. The return will be 5%, and the total amount of funds will be 105,361 tenge at the end of 2022. The maximum return that could be netted in February 2022 is 13% when the price of gold increased significantly. In general, investments in gold are considered long-term, so it is difficult to assess the investment attractiveness of this instrument within 2 years.

Tenge deposits can be considered the most profitable investment tool following our calculations. In addition, deposits always bring a stable income. For sure, investing in stocks can help you earn more, but there are risks of being left without income or being in the red altogether. We recommend our readers to diversify their savings and invest in different instruments. We also suggest paying attention to deposit products of Jusan Bank and Jusan Invest application.

Сунгат Рысбек

Сунгат Рысбек