Kazakhstan is known to the world market as a producer of grain, primarily wheat. The priority for grain was formed back in Soviet times and, most likely, is dictated not by the efficiency of their cultivation in the republic, but by the need for a large country in food security. Further development in this direction was largely based on the principle – “because it has always been done this way.”

During the Soviet era (1986-1990), the yield of Kazakhstan wheat averaged 12.6 quintals per hectare. And even in this period before the collapse of the Union, the yield was higher than it is now.

In the 1980s, grain production in Kazakhstan was ensured by the intensification of production. 50% of the crop was formed due to the use of mineral fertilizers, 20% – due to the use of zoned varieties and 30% – due to compliance with technology. But due to organizational changes carried out in the agricultural sector this proportion is violated, also because of violations in the technology of cultivation of grain crops, price disparity and other factors.

Kazakhstan ranks 109th out of 130 countries cultivating wheat in this yield. Our country mainly grows soft wheat of strong varieties, which contains a lot of protein (gluten), but has a low yield relative to soft weak varieties. However, even among countries with comparable wheat varieties, Kazakhstan wheat has the lowest yield.

Table 1. The yield of wheat of various varieties in the world, q/ha

| 1992-1996 | 1997-2001 | 2002-2006 | 2007-2011 | 2012-2016 | 2017-2020 | |

| countries cultivating weak wheat varieties | ||||||

| New Zealand | 53 | 66 | 75 | 80 | 91 | 92 |

| EU countries | 63 | 65 | 66 | 69 | 72 | 70 |

| Egypt | 54 | 63 | 65 | 63 | 66 | 65 |

| Saudi Arabia | 45 | 46 | 54 | 60 | 62 | 60 |

| China | 37 | 38 | 43 | 48 | 53 | 56 |

| Ukraine | 30 | 26 | 28 | 31 | 39 | 39 |

| Russia | 16 | 17 | 19 | 21 | 26 | 28 |

| countries cultivating strong wheat varieties | ||||||

| Canada | 22 | 22 | 25 | 29 | 33 | 34 |

| USA | 25 | 27 | 28 | 30 | 31 | 33 |

| Argentina | 21 | 24 | 25 | 28 | 29 | 31 |

| Australia | 18 | 19 | 15 | 17 | 21 | 17 |

| Kazakhstan | 8 | 10 | 10 | 11 | 12 | 11 |

Source: calculated on FAOSTAT data

Low wheat yield in Kazakhstan compared to most countries may be a consequence of insufficient use of fertilizers. Kazakhstan occupies one of the last places in the world – 155 out of 170 countries in the use of fertilizers (total) per hectare of arable land. Thus, the use of fertilizers is almost 5 times lower than in Russia, and almost 100 times less than the leaders. Insufficient use of fertilizers limits the volume and quality of the harvested crop.

Table 2. Use of fertilizers, kg/ha

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Egypt | 424.0 | 435.8 | 412.4 | 406.2 | 401.2 |

| China | 403.7 | 391.6 | 369.6 | 350.0 | 336.8 |

| Netherlands | 281.3 | 280.3 | 264.4 | 264.0 | 267.9 |

| Great Britain | 245.9 | 246.6 | 243.8 | 243.2 | 189.4 |

| Israel | 211.2 | 184.2 | 191.0 | 182.9 | 94.3 |

| Belarus | 143.8 | 139.7 | 153.2 | 151.1 | 177.6 |

| Uzbekistan | 231.6 | 231.8 | 231.8 | 230.8 | 230.7 |

| France | 154.8 | 168.5 | 162.7 | 148.4 | 160.0 |

| India | 153.3 | 157.4 | 162.2 | 171.8 | 192.9 |

| USA | 125.7 | 125.6 | 124.8 | 124.4 | 124.0 |

| Ukraine | 51.3 | 60.2 | 63.7 | 63.4 | 73.7 |

| Russia | 18.4 | 17.0 | 20.5 | 22.3 | 25.0 |

| Kazakhstan | 3.8 | 5.3 | 4.0 | 1.9 | 5.6 |

Source: calculated on FAOSTAT data

Wheat trade

Kazakhstan accounts for about 2% of the world wheat trade. Wheat exports in the last five years have averaged 5 million tons per year.

The low yield of strong wheat varieties is compensated by their higher cost. Such wheat has baking properties due to its high protein content and can serve as an improver in the production of flour from weak varieties. Accordingly, the demand for it is higher than for more affordable weak wheat.

Strong varieties of soft wheat are grown in certain climatic zones. And only following a few countries cultivate these varieties: the USA, Canada, Australia, Argentina and Kazakhstan. At the same time, due to the unstable quality of wheat produced and its weak promotion on the world market, Kazakhstan is practically unknown to the world market as a producer of high-quality wheat.

The main consumer countries of Kazakhstan wheat are neighbouring countries from the CIS. For 20 years (from 2001 to 2021), Kazakhstan exported its wheat to 72 countries, but only 2 countries purchased Kazakhstan wheat throughout the period with stable volumes – Uzbekistan and Tajikistan. These two countries account for 60-70% of supplies. Another 7 countries buy Kazakhstan wheat relatively regularly, but in small volumes, for example, Turkey and Italy.

Firstly, it is necessary to improve the quality of wheat produced from the current grade 3 to grades 1-2 to change the situation. In addition, necessary to actively promote Kazakhstan wheat to the world market:

- to participate in international exhibitions where the country could demonstrate high-quality wheat;

- to supply free trial batches to interested countries;

- to achieve a stable quality of wheat produced from year to year.

But are there any manufacturers interested in this? If the current state of affairs guarantees income, is the manufacturer or the state interested in actively promoting products for which it is necessary to spend large financial resources?

Agricultural potential

At the same time, we see potential. Take at least the land resources of Kazakhstan. As a rule, a significant territory implies a high agricultural potential.

According to the Food and Agriculture Organization of the United Nations (FAO), Kazakhstan ranks 6th in agricultural land (79% of the country’s area), a bit behind Russia (see Table 3). However, arable land accounts for only 14% of agricultural land. This means that a significant amount of agricultural land in Kazakhstan falls on uncultivated land – range lands, meadows and steppes.

Table 3. The area of the countries, their agricultural areas and arable lands, thousand hectares

| area of the country | agricult. area | arable lands | the share of agricult. areas from the total area of the country | share of arable land from agricult. areas | |

| Russia | 1 709 825 | 215 494 | 123 442 | 13% | 57% |

| Canada | 987 975 | 58 035 | 38 693 | 6% | 67% |

| China | 983 151 | 527 722 | 134 889 | 54% | 26% |

| USA | 956 291 | 405 701 | 160 328 | 42% | 40% |

| Brazil | 851 577 | 236 735 | 63 465 | 28% | 27% |

| Australia | 774 122 | 358 317 | 30 935 | 46% | 9% |

| India | 328 726 | 179 204 | 168 866 | 55% | 94% |

| Argentina | 278 040 | 110 110 | 34 485 | 40% | 31% |

| Kazakhstan | 272 490 | 215 294 | 29 728 | 79% | 14% |

Source: calculated on FAOSTAT data

Crop production occupies a little more than half – 52-54% of the structure of agricultural production in Kazakhstan. At the same time, as we noted earlier, the share of arable land is low – only 14% of agricultural land, which means that about 85% of the land is more suitable for livestock husbandry.

Division of areas by crops

Grain crops are the basis of crop production in Kazakhstan. They accounted for about 90% of the acreage until 2007. Then their share is gradually decreasing and has recently been about 80%.

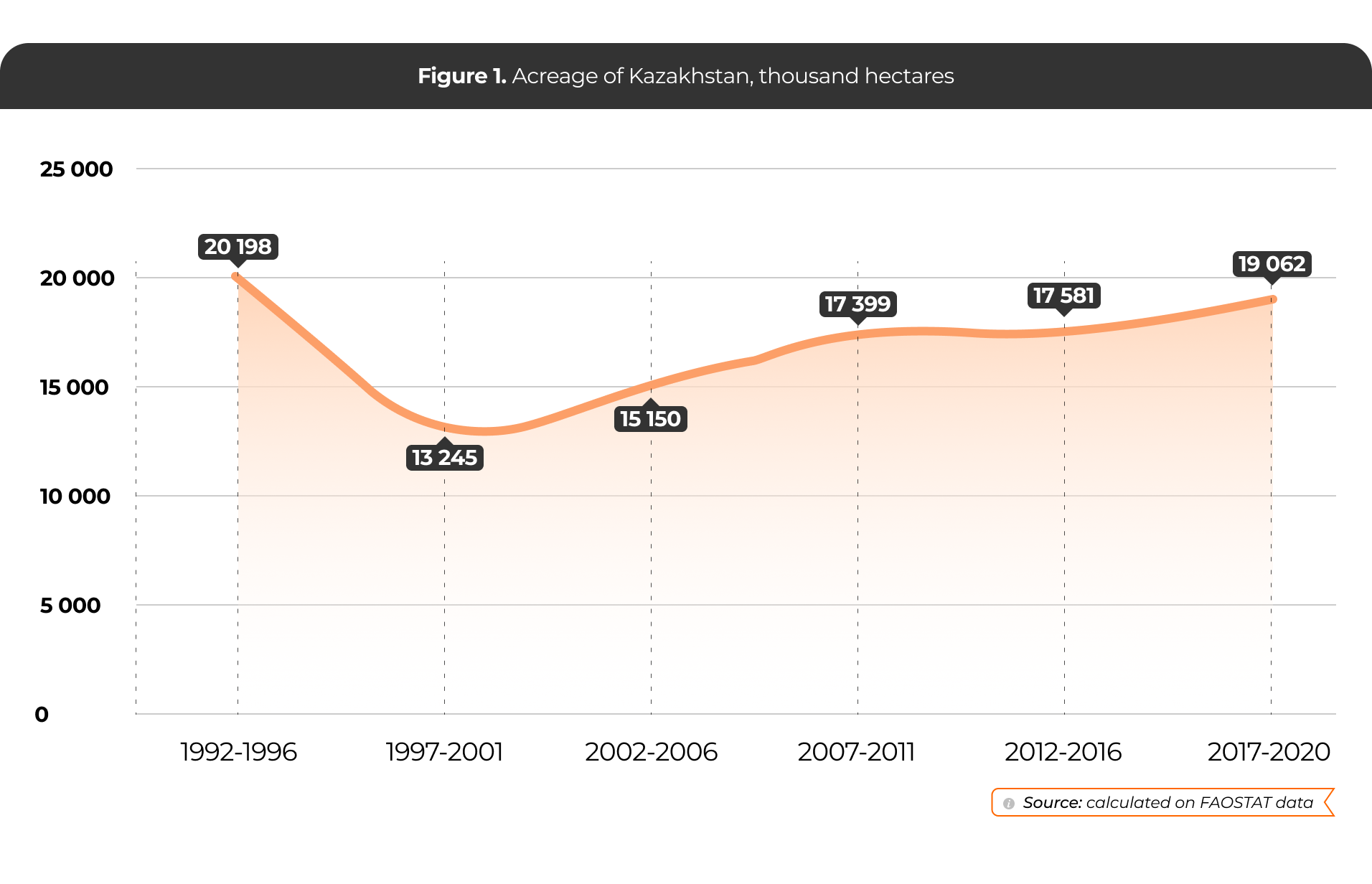

The greatest reduction in acreage for major crops occurred in the first years of independence (1992-1996), and then the land use in Kazakhstan increased, but still has not reached the level of 1992.

Oilseeds have been gradually winning back their share in the structure of the area since 2007. At the same time, the area for grain is not reduced, which indicates an increase in the use of arable land.

From the structure of the acreage follows that vegetables, fruits and root crops occupy very low shares. And such a structure has developed historically. However, the structure of the crop is slightly different from the structure of the acreage. Cereals keep the leadership, but with a significantly smaller share. Root crops (potatoes) and vegetables occupy a share of less than 1% of the acreage, but their share in the volume of harvests is more than 10%. It should be noted that there was a systematic increase in the yield for all major crops.

The yield of all crops has increased, but cereals are not the leaders of progress again over the past 30 years. They increased the yield by about 1.5 times, while vegetables and fruits by more than 2.5 times.

It suggests whether grain crops are the most effective for growing in Kazakhstan.

Alternative to wheat

Tomatoes, potatoes, apples, apricots, etc. are significantly superior to wheat in terms of returns per hectare of acreage. Moreover, Kazakhstan imports most vegetables and fruits, although it could produce itself. But there is a certain complexity here. Now most fruits and vegetables are grown in the households of the population, extensively, not on an industrial scale, although we can see a great prospect for the development of such production.

If you look at the gross profit received from the sale of 1 centner of production, wheat is also inferior to vegetables and fruits.

Table 4. The volume of gross profit from the sale of 1 centner of production, tenge

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Tomatoes | 16 471 | 8 424 | 1 823 | 27 179 | 24 956 |

| Apricots | 8 823 | -4 902 | 14 153 | 6 247 | 7 615 |

| Apples | 4 775 | 5 916 | 5 351 | 10 017 | 6 977 |

| Soy beans | 1 692 | 2 925 | 3 151 | 6 095 | 3 114 |

| Corn | 1 245 | 1 204 | 814 | 2 510 | 2 935 |

| Flax | 1 882 | 2 687 | 1 459 | 2 781 | 2 921 |

| Potato | 977 | 2 018 | 2 713 | 3 194 | 1 996 |

| Sunflower | 3 289 | 2 582 | 2 105 | 1 455 | 1 793 |

| Wheat | 992 | 807 | 119 | 1 308 | 1 569 |

| Rice | 1 766 | 731 | 178 | 578 | 257 |

| Sugar beet | -108 | 34 | -103 | -1 152 | -829 |

Source: calculated on FAOSTAT and the Bureau of the National Statistics of the Republic of Kazakhstan data

Which way to go

Following the above data, wheat may not be the most effective crop in Kazakhstan and it is worth reviewing priorities in the structure of crop production or reconsidering approaches to wheat cultivation, to make it an effective and highly profitable product.

Based on the production and export of wheat over a long period, we can say that 10-12 million tons of wheat are needed to maintain the country’s food security. Kazakhstan can also produce this volume through extensive economic development, as it is now, without investing many resources in improving the quality and efficiency of the production. Consequently, it is possible to reduce the acreage used for wheat and switch to growing other more efficient crops.

Or we could go the other way: increase yields, and improve quality, while developing an aggressive marketing policy to promote goods to the world market.

Which of these ways is acceptable for Kazakhstan largely depends on the goals being set: to stop chasing the leadership in wheat exports and start actively engaging in other crops, or to try to make Kazakhstan wheat a pattern, which is not inferior to analogues from Australia and Canada that have land resources and climatic zones similar to Kazakhstan. Or maybe try to combine them?

Тимур Дауранов

Тимур Дауранов