Inflation has become a global phenomenon in 2022. This was due to accumulated economic and social imbalances in the global economy during the COVID-19 pandemic, which was caused by policies to mitigate the pandemic adverse effects: increased government spending, excessive demand stimulation, accumulation of leverage and distortion of the competitive market environment.

Geopolitical tensions have revealed and worsened previously accumulated problems and have become a new cause of continuing disruptions and difficulties in global supply and production chains. And this has led to a shortage of goods in local markets, thereby distorting market pricing. Prices are rising and their growth rates are measured in double digits, in some countries inflation has reached record-high levels. Previously available goods are already becoming unaffordably expensive, which plunges a lot of people into poverty and is a sign of a rampant crisis in the cost of living in the world.

Financial regulators and governments of the largest countries are trying to counteract the increased price pressure with monetary and non-monetary measures. The measures taken are the most decisive in recent decades and represent the end of the era of easy money in the economy. However, prolonged exposure to high and rising prices worsens future inflation expectations. And people are buying more expecting further price increases – thus, despite the measures of central banks to limit high demand remains. Therefore, all anti-inflationary measures are now less effective in coping with their goal of curbing inflation, but their adverse effect on slowing business activity is already noticeable.

This year we have entered a new cycle characterized by a prolonged period of abnormally high inflation and weak/negative growth. These undesirable trends increase stagflationary risks that cloud economic growth prospects and critically increase the likelihood of additional financial crises.

Countries are being dragged into the stagflation whirlpool

Current assessment

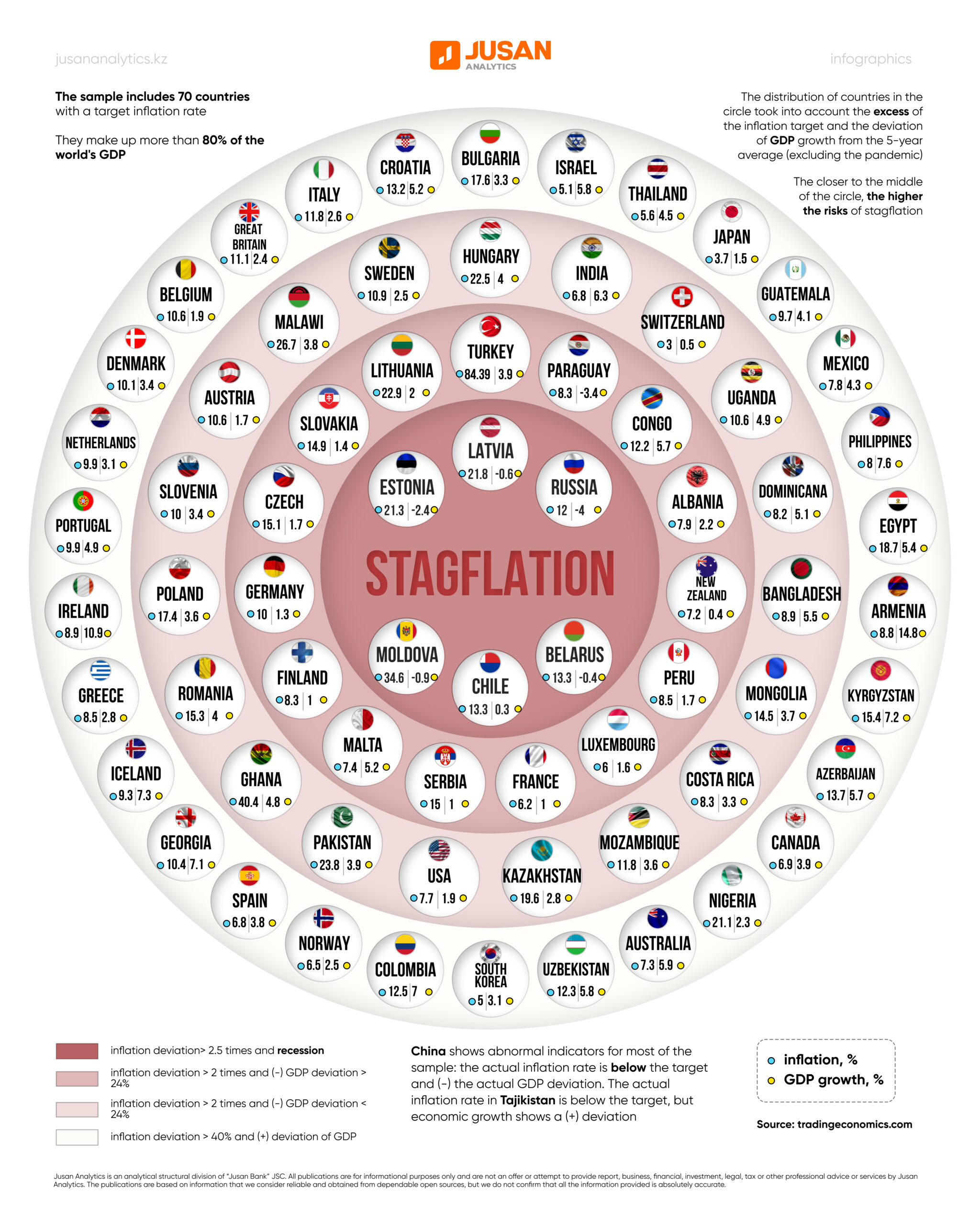

The infographic above shows the current situation regarding the world’s exposure to the risk of stagflation. Jusan Analytics has analyzed the latest data on the inflationary processes for October-November 2022 and economic growth in developed and developing countries for September 2022.

The sample included 70 countries of the world, which account for more than 80% of global GDP. Their distribution considered the excess of inflation of the officially established target by its level (target) and the deviation of GDP growth from the average over the past 5 years, except for the pandemic period (2020-2021).

Stagflationary risks have been carried into effect in Latvia, Estonia, Moldova, Russia, Belarus and Chile. The inflation in these countries significantly exceeds their target (from 2.5 to more than 10 times), and GDP growth rates are negative – indicating a recession. They account for just over 2.3% of the global GDP.

The current dynamics of inflation and GDP growth are highly likely to develop into stagflation in Turkey, Albania, France, Germany, the Czech Republic and other countries of the second circle. This group (15 countries) unites countries where the level of actual price growth exceeds the target by more than 2 times, and the current economic growth rate deviates downward from the average by more than a quarter. The countries included in this group account for 9.8% of the world’s GDP.

There is an excess of the target and a slight slowdown in economic growth in India, Switzerland, the USA, Kazakhstan, Poland, Austria and other countries of the group. These 19 countries are also united by exceeding the inflation rate of their target and a less significant negative deviation in the actual GDP growth rates than in the previous group. These countries account for more than 31% of the global GDP.

The inflation exceeds the target, but the economy continues to grow in Georgia, Italy, South Korea, Canada, Australia, Azerbaijan, Kyrgyzstan, Uzbekistan, Armenia and other countries of the fourth circle. This group of 30 countries is united by a positive GDP growth of more than 40% and an increased inflation rate.

The reasons are various in all countries, but they cannot be called balanced and sustainable economic growth. It is not possible to ensure sustainable economic growth in terms of increased internal and external price pressure and retaliatory monetary restrictive measures.

For example, economic growth is significantly higher than the growth rates of previous years in Armenia and Kyrgyzstan and is due to a one-time factor: the influx of e-transfers from Russia and the presence of Russian citizens in these countries.

The countries included in this group account for almost a third of the world’s GDP.

Our sample also includes the second economy in the world – China (more than 18% of the global GDP). Price dynamics there reflect deflation, and economic growth slows down against the background of a zero-tolerance policy for COVID-19.

What’s next?

Next year is likely to be more difficult than this and assumes general macroeconomic turbulence and geopolitical tensions. The main negative factor for the global economy in 2022 is the increased and stubborn price growth that may be replaced by a new threat (the onset of a stagflation period on a global scale), which was mentioned by British politician Ian MacLeod in 1965. The central banks of the world’s leading economies risk going too far in pursuit of curbing price increases and “leading to the worst of the worlds – not just inflation on the one hand or stagnation on the other, but both of them together.”

At the same time, the overall global inflationary background is most probably to stabilize, just because of the massive reversal of countries towards tightening monetary conditions. However, there are concerns that the current monetary measures to combat inflation are already sufficient and it is necessary not to miss the pivot point to stabilization and mitigation of the monetary policy. Otherwise, it is possible to repeat the same scenario that partly influenced the current situation with inflation – no one was able to stop the stimulus measures previously taken to overcome the coronacrisis in time, and they began to transform from temporary to permanent.

Now the situation in the leading economies of the world – the USA, the European Union, Great Britain and China – is raising concerns. The first three economies are at risk of experiencing more difficult times, where economic growth is under pressure from increased sustained inflation and the response of the central banks of these countries to contain it. Even in an optimistic scenario, the situation may develop as a slowdown but maintain weakly positive economic growth. Otherwise, if inflation does not react to the measures already taken to tighten monetary conditions and additional aggressive steps in this direction are required, then the economic activity is likely to decrease significantly.

But it is possible to restore business activity in case of rejection of tough anti-COVID measures or improvement of the epidemiological situation. At the same time, the recovery of the Celestial Empire’s economy on global markets may result in a huge volume of deferred demand and cause a second wave of price increases for all categories of goods and services.

Combating rising inflation and cooling economic activity will also be a priority for developing countries. However, exogenous risks, to which they are more susceptible than developed countries, will limit the speed and effectiveness of government measures taken. With the internal imbalances, the pressure will come from the increasing debt and currency risks, which may lead to a longer recession.

The negative spread of short and long bonds is also alarming (-80 bps is the maximum inverse value for more than 40 years in the United States), which serves as an indicator of early warning of crisis phenomena and is a factor in favour of a greater negative scenario probability. Thus, in early December 2022, the Fitch rating agency lowered its forecast for global GDP growth for 2023 from 1.7% to 1.4%. Goldman Sachs economists also believe that global growth will slow over the next 10 years to less than 3% per year. The main factor in favour of revising estimates was the negative effects of measures to curb price pressure on economic growth.

The International Monetary Fund agrees that the worst is yet to come for global economic growth. The pace of global economic growth next year will be below 2.7%, which the IMF predicted in October 2022. The projected global economic growth rate in 2023 is the lowest since 2001, except for the periods of the global financial crisis and the acute phase of the COVID-19 pandemic.

As IMF Managing Director Kristalina Georgieva said in her October speech, “the global economy is experiencing a fundamental shift, a transition from a predictable world to a world with increased uncertainty and geopolitical confrontation, a world in which any country can deviate from its intended course faster and more often.” In the current difficult conditions, there are no universal and easy-to-implement means to avoid global stagflation. Therefore, it is most notable to identify a balanced and proactive approach that will avoid major difficulties. It is necessary to make joint and concerted efforts to smooth out the consequences of geopolitical tensions and counteract the temptations of further deglobalization of market relations. It is necessary to build a new, more crisis-resistant model of economic development to avoid a hard landing and a prolonged recession pit.

Айжан Алибекова

Айжан Алибекова