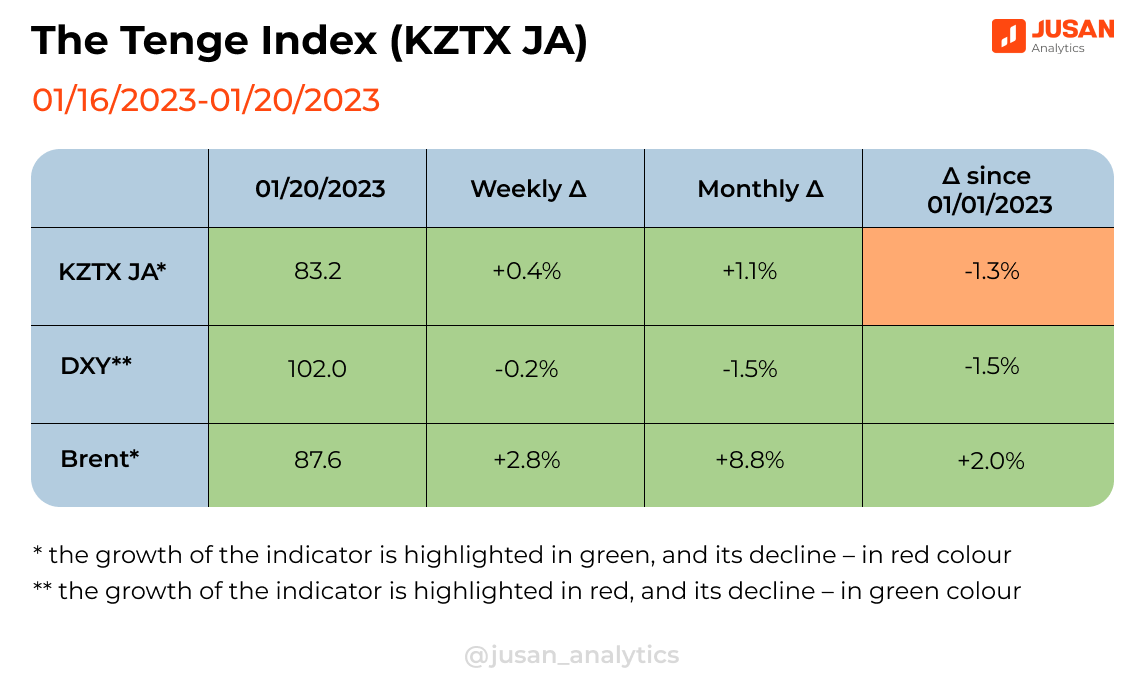

Following the results of last Friday, The Tenge Index strengthened the growth of the previous week (January 9-13, 2023). This is largely due to the tenge strengthening against the Russian ruble. The exchange rate dynamics are explained by the belated reaction of the tenge to the past ruble weakening against world currencies amid the sanctions imposed. In the future, the growth of the discount on Urals crude oil may prompt Russia to respond by reducing production and weakening the Russian ruble simultaneously.

The lack of more response to the global dollar weakening position and the rising cost of oil may be a sign of the initial restrengthening of the tenge.

Oil prices, with optimism due to forecasts for an increase in demand from China for energy sources, as well as limited supply against the background of anti-Russian sanctions, continue to rise for the second week in a row. We believe that the next week will not bring any special changes to the oil market, since the celebration of the Chinese New Year will temporarily reduce the demand for fuel from China. However, the demand may increase rapidly with the resumption of factories in China, and this will cause both fears among consumers and hope among sellers of energy resources on world markets.

At the same time, the Fed’s upcoming meeting is also a potential factor for a temporary increase in world market volatility. Since earlier the Fed’s management has signalled to the market about slowing down the rate hikes, and another increase of 50 bps may come as a surprise to the market.

You can go through the dynamics of the Tenge Index changes at: https://jusananalytics.kz/en/kztxja/

Айжан Алибекова

Айжан Алибекова