Sanction restrictions against Russia affect not only it, but all participants in the global economy and especially countries that are closely integrated into trade with it.

Even though the share of the Russian Federation in global GDP does not exceed 2.0% (or 1.5 trillion US dollars), which, for example, is less than the economy of the states of Texas (1.8 million dollars) or New York (1.7 million dollars), the country occupies a leading position in key production processes, ensures the functioning of the most important transport-logistics corridors, and plays a leading role in commodity markets.

So, if we consider only natural resources, the Russian Federation is among the five world producers of oil, gas, palladium, nickel, aluminum, titanium, copper, gold and steel.

The country also exports a large number of rare metals, without which the global production of high-tech equipment and semiconductors becomes quite difficult. In addition to natural resources, Russia is the largest supplier of fertilizers, wheat, sunflower oil and other key food products.

Kazakhstan is an economically close associate of Russia. Intentionally or as a result of the Russian economic transformation and the strengthening of structural problems in its main neighbors, Russia has significantly increased its economic influence after the introduction of the first sanctions in 2014. Accordingly, all internal and external shocks in the Russian economy, including international sanctions, directly affect Kazakhstan. However, the sanctions isolation of the northern neighbor not only causes risks and threats but also provides several advantages for the domestic economic growth.

Old problem issues

Sanctions against the Russian Federation have exposed Kazakhstan’s chronic sore spots, which have been in remission for a long time.

Inflation blow

The rapid acceleration of inflation is one of the most serious threats to Kazakhstan as an import–dependent country. Thus, the Russian Federation accounts for about 40% of all domestic imports. At the same time, the share of imports from Russia in some vital positions exceeds 80%.

In this regard, anti-Russian sanctions and retaliatory measures of the Russian government primarily lead to inflationary pressure, purchasing power erosion and a decrease in the living standard of Kazakhstanis. Thus, with the target average annual inflation rate in the range of 4-6%, the actual price increase in July of this year amounted to 15% in annual terms.

On a components basis, the largest contribution to the price swing was made by food products, which rose in price by 19.7% YoY over the year. Non–food products for the same period increased by 14.2% YoY, and services – by 9.2% YoY. Domestic market prices of Kazakhstan have also got an additional boost to growth due to the unexpected export embargo from Russia. Recall that the Russian authorities have restricted the export of several key food products to foreign markets, including the EAEU countries and Kazakhstan to stabilize domestic prices.

Currency vulnerability

The ruble has become not just a means of payment, but also one of Russia’s main geopolitical and geo-economic instruments in protecting its economy from external threats and promoting national interests under the conditions of international sanctions. The exchange rate of the Russian national currency against the background of the sanctions blockade is determined not by market factors, but by Russia’s national priorities. An excessive appreciation or easing of the Russian currency is an additional risk for the largest trading partners of the Russian Federation, which includes Kazakhstan with a turnover of $ 24.2 billion. On the one hand, with the excessive strengthening of the ruble, there is an increase in the cost of critically important and difficult-to-replace Russian products. On the other hand, non-market depreciation of the Russian currency and price dumping may lead to increased influence on the domestic market of Kazakhstan.

In addition, Russia seeks to increase ruble convertibility by increasing settlement payments in national currencies. Thus, the growing share of the Russian ruble in the currency basket of Kazakhstan may present new pitfalls, since the Republic of Kazakhstan uses the currency of a sub-sanctioned country.

Domestic market capture

Having lost access to almost all foreign markets, Russian manufacturers are striving to preserve and strengthen their niches in the remaining neighboring countries. Kazakhstan may be threatened by the economic expansion of Russian goods and a decrease in the domestic share of local products in the market. Such a negative scenario is very likely, since having lost the opportunity to export goods to most countries of the world, Russian companies will try to compensate for their losses by expanding in existing country directions. Given the higher level of capital-labor ratio and budgets, companies from the Russian Federation that previously worked for both an external buyer and the Russian Federation citizens can quickly reorient their production and sales towards Kazakhstan and win competition due to economies of scale. Kazakhstan manufacturers may not be able to compete for a local buyer in the conditions of dumping and other strategies of Russian companies.

Blocking of transit

If the acceleration of inflation is a sore point, then blocking the transit of Kazakhstan’s energy resources through the territory of the Russian Federation is the Achilles heel of Kazakhstan. Kazakhstan exports more than 90% of oil through the transport and transit infrastructure of Russia. Only about 80% of Kazakhstan’s oil to foreign markets passes through the Caspian Pipeline Consortium (CPC). For example, Kazakhstan exports 70% of its oil to the EU, which is about 6% of the total imports of the European Union. The CPC’s activities have been stopped three times since the beginning of the year, which negatively affected the socio-economic situation of the country. Oil accounts for more than 50% of Kazakhstan’s export structure, and oil revenues provide about 1/3 of the budget of the Republic of Kazakhstan.

New opportunities

Paradoxically the anti-Russian sanctions not only exposed Kazakhstan’s problem issues but also “hacked way through” a window of new opportunities and created growth points for the country.

Relocation of technology companies

The conflict in Ukraine has led to the migration of technology companies and specialists from Russia, Ukraine and Belarus. Kazakhstan has the potential to become a magnet for the IT industry from the region and the world. This is especially relevant to international and regional technology startups, which are more mobile in comparison with traditional sectors of the economy.

Kazakhstan has competitive advantages in this direction. Thus, the country began to create an ecosystem for the relocation of advanced technology teams from abroad way before any regional conflicts. In 2017, Astana International Financial Center was established. Astana Hub, MOST business incubator, “Terricon Valley” IT-hub, as well as other public and private support institutions operate in the country. Some foreign companies have already taken advantage of these opportunities. For example, in early August, the Ukrainian Treeum IT company entered the Kazakh market and opened a regional hub in Almaty.

The sanctions blockade of the Russian Federation has also given a new impetus to “IT nomads” resettlement to Kazakhstan. Thus, several international technology giants with a total capitalization of over $ 27 billion have fully or partially moved to Kazakhstan’s jurisdiction:

Thus, Tinkoff Bank has opened development centers in the capital and megametropolis of Almaty for the development of new digital financial services. The offices in Kazakhstan will complement the existing 22 Tinkoff centers in other countries, where analysts, engineers, developers and other specialists from around the world work.

inDriver international transportation service has also announced its relocation to Kazakhstan within the development of regional hubs. For today, the key team is here. Kazakhstan is the largest market for the company in the CIS. inDriver is supported by investors such as Insight Partners, Bond Capital, and General Catalyst.

One of the world leaders in mobile games with a market capitalization of over $ 17 billion Playrix has also settled in Kazakhstan. There are regional divisions of the company in Almaty and Nur-Sultan cities. In 2020, Playrix became the world’s largest mobile game developer, second only to Tencent.

Moreover, Kazakhstan was chosen as the main or one of the main locations by Type Type, Level Travel, RedMadRobot, and LNG Partners.

This list can fall into line with many other technological pioneers with proper positioning and promotion of Kazakhstan. The arrival of strong foreign technology players will also strengthen competition in the domestic market, improve the quality of products and services offered, create synergies and free fast-growing technology industries from weakly competitive participants.

However, Kazakhstan is going head to head with strong regional rivals in the face of Armenia, the United Arab Emirates, Cyprus, Uzbekistan, Georgia and Turkey for attracting technology companies. For example, Yandex has relocated a significant staff to Armenia. Miro Company, which was valued at $17 billion last December, also opened an office in this Transcaucasian Republic. Against the background of the Ukrainian-Russian conflict and sanctions, the Belarusian technology giant EPAM has strengthened in Uzbekistan, and relocated up to a thousand of its employees from Russia and Belarus to this country.

The EAEU Market

International sanctions against Russia are for a long time, if not forever. Despite or even thanks to sanctions, Kazakhstan may become a new main entry point for international companies into the EAEU and Central Asian countries unified market for the first time. Previously, this role belonged to Russia and partly to Belarus. However, after the sanctions isolation, Kazakhstan remains the only major country within the EAEU that has a profitable potential for international cooperation. Thus, the French concern Alstom announced plans to invest more than 50 million euros in the Kazakh economy.

The EAEU currently generates about 4.0% of the global GDP. About 185 million people live on the territory of the states of the economic bloc, which unites Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia.

Strengthening competitive advantages and new growth points

Russia is being pushed out of European markets, where it has traditionally dominated. Russia is reorienting exports from Europe to Asia in response to these actions. Kazakhstan, being one of the largest producers and exporters of raw materials to world markets, can occupy the vacant economic niches in Europe. At the same time, European countries themselves are showing interest in diversifying supplies and expanding the supplier base. Thus, the EU plans to double gas supplies from Azerbaijan over the next five years. In general, in January-February of this year, Kazakhstan increased wheat exports to the EU by 13 times, gas – by 4.3 times, and petroleum products – by 40%.

However, in addition to traditional raw materials, Kazakhstan also has deposits of certain rare earth metals. Today, this segment is dominated by only a few countries, including China. Developed countries in the context of a fresh geopolitical strain and disruptions in global supply chains are interested in getting access to raw materials from new suppliers. Thus, on June 21 of this year, was held the first meeting of the working group on trade and economic cooperation in the field of rare earth metals between Kazakhstan and the United States. The parties discussed the prospects of cooperation between Kazakh and American businesses in the field of extraction and processing of rare earth metals. And following the meeting, the American side agreed to provide Kazakhstan with technologies for the extraction and processing of raw materials.

As a conclusion: Kazakhstan is a new path for the development of Eurasia

Sanctions against Russia turned out to be a double-edged sword for Kazakhstan. On the one hand, the common membership in the EAEU, the longest land border in the world, the joint infrastructure left over from the Soviet era, and economic complementarity cause an almost instant spread of all negative manifestations from Russia to Kazakhstan.

On the other hand, in addition to the previously announced advantages, it can become a springboard for Kazakhstan: it can become an alternative track of Eurasian development (instead of Russia), which will favorably affect the stability of the region and the global economy entirely.

Reference information:

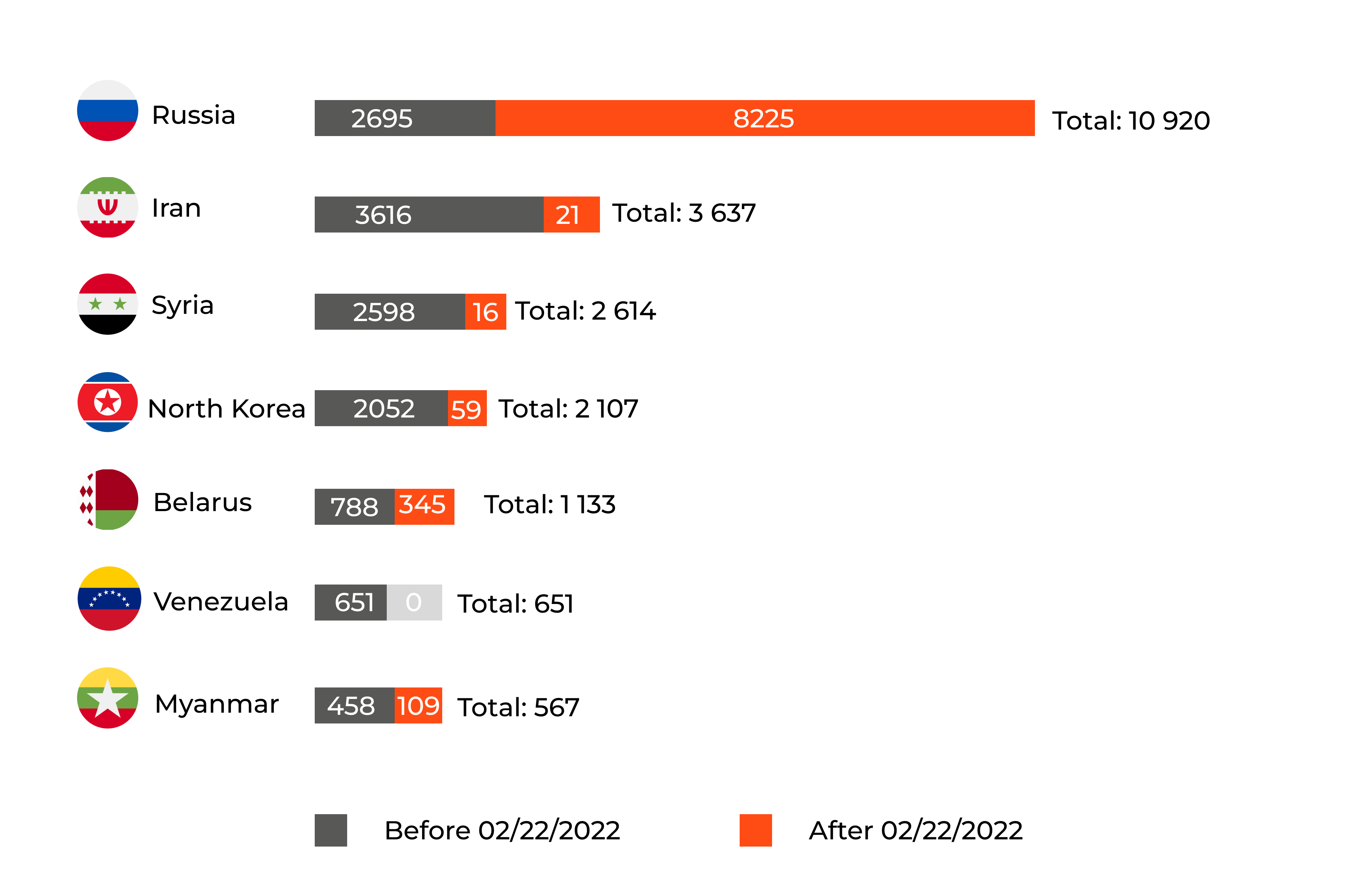

Since February 2022, unprecedented international sanctions have been imposed against Russia in terms of scale, speed and scope. As a result, the country took the cake in the number of sanctions imposed against it, confidently overtaking Iran, Syria, North Korea, and Venezuela combined.

Unlike previous historical precedents, the current sanctions restrictions were supported not only by the governments of most developed countries of the world but also by the corporate sector. Thus, since the beginning of hostilities in Ukraine, more than 1,000 major international companies have broken with commercial relations and left the Russian market.

Рафаэль Жансултанов

Рафаэль Жансултанов