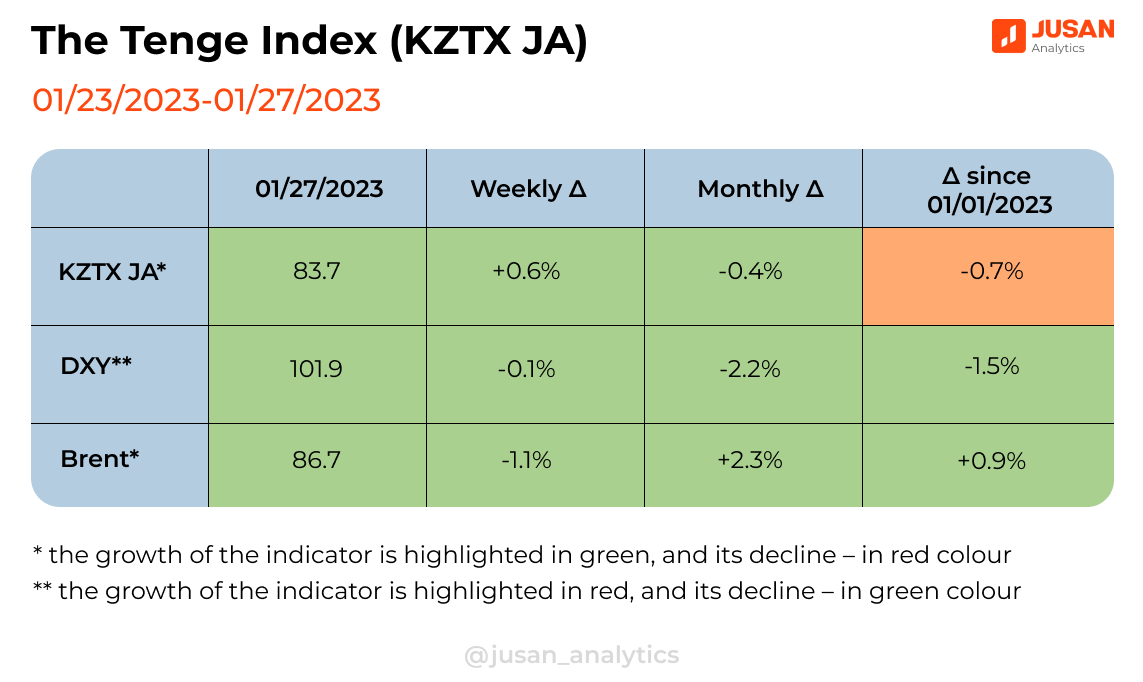

The Tenge Index increased by 0.6% over the week, it reflects the strengthening of the national currency against the dollar and ruble. The weakening of the Russian currency is due to the end of the tax period and, as a result, a reduction in the supply of foreign currency. The discount on the Russian oil brand also affects it, and this significantly scales down the inflow of export earnings to Russia.

The Dollar Index last week fell to June values due to expectations for easing the Fed’s policy and making appropriate decisions at the next meeting. However, data on the US economy for the 4th quarter of 2022 were released by the end of the week: GDP growth rates were higher than analysts’ expectations (2.9% versus the expected 2.5%). And thanks to this, everyone again began to take seriously the Fed’s rhetoric about the need to continue cooling demand. Thus, the Index rose slightly and closed at 101.93.

The price of Brent crude oil fell from 87.63 to 86.66 dollars per barrel. The reason was the low activity of demand in Asian markets due to the celebration of the Lunar New Year in China. An additional factor in the price decline was data on oil reserves in the United States: the American Petroleum Institute (API) reported that stocks increased by 3.4 million barrels over the week. By the end of the week, oil prices rose to $ 87.47 per barrel due to the US currency weakening. Low oil prices and the dollar weakening have interested foreign buyers.

The current week is full of significant events. China is coming back after a long weekend. Analysts expect an increase in demand due to the lifting of quarantine restrictions and the energy consumption increase in China.

You can go through the dynamics of the Tenge Index changes at: https://jusananalytics.kz/en/kztxja/

Сунгат Рысбек

Сунгат Рысбек