Last year, “Caspian Pipeline Consortium-R” JSC (CPC), through which most of Kazakhstan’s oil (about 80%) is transported, suspended its activities several times. And as a result, this had strongly impacted the mining industry, where gross added value decreased by 1% by the end of 2022.

Recently, news on oil shipment was again stopped at the CPC marine terminal from February 19 to 22 appeared. The media had also information that the CPC suspended oil acceptance from the Tengiz deposit.

In our opinion, the “CPC factor” is now the most constant, major and unpredictable risk for the further development of Kazakhstan’s economy, which is very dependent on its oil and gas sector. The previously announced plans of the Government and KazMunayGas to diversify oil exports through the Baku-Tbilisi-Ceyhan route after the recent tragic events in Turkey have become practically unworkable.

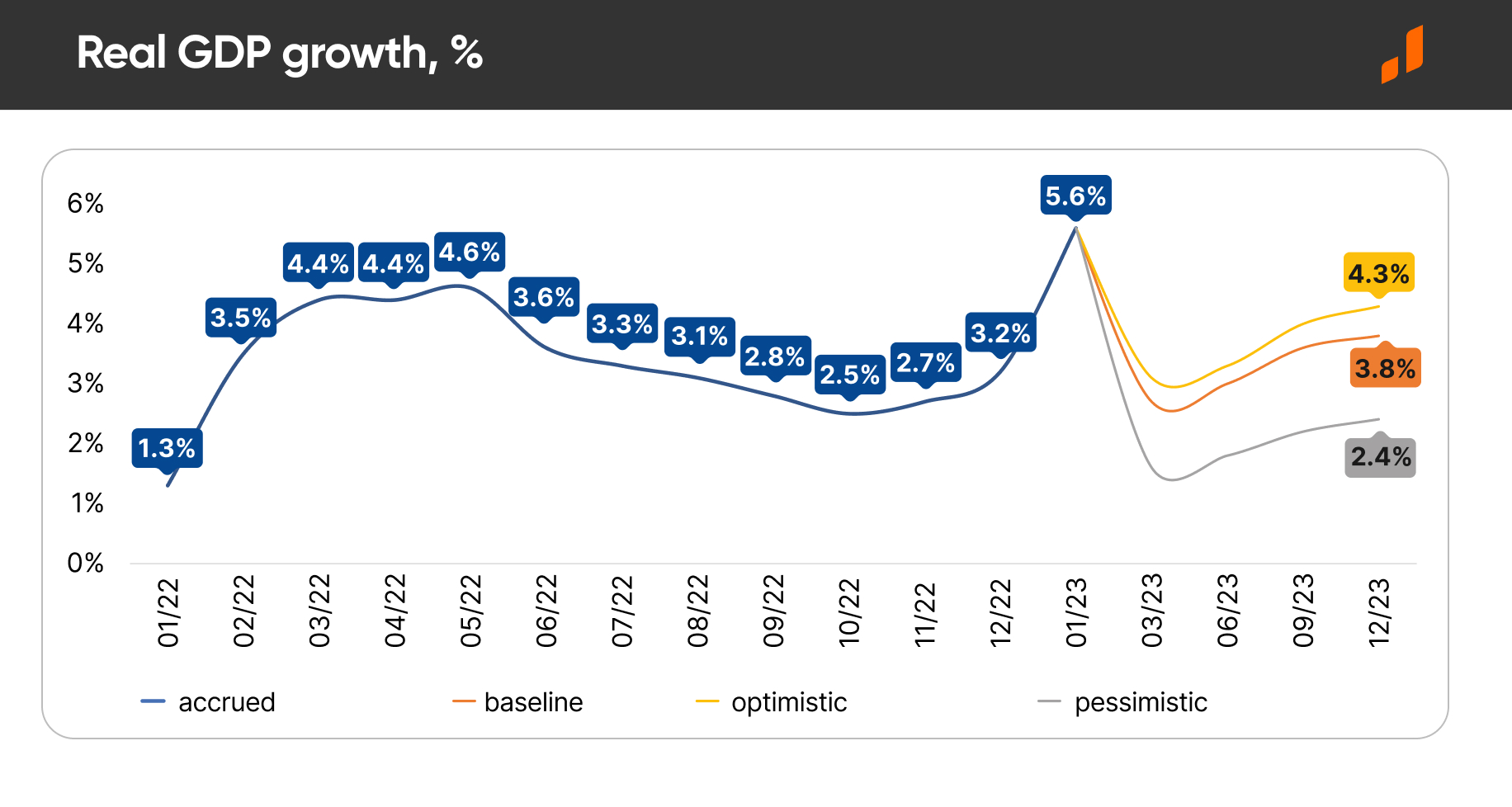

Thus, when building our macroeconomic forecasts for Kazakhstan’s development, we also considered a pessimistic scenario that included the risks of the raw materials sector. Our real GDP forecast following the pessimistic scenario is 2.4%, which is significantly lower than the previously announced range of 3.8-4.3%.

Клара Сейдахметова

Клара Сейдахметова